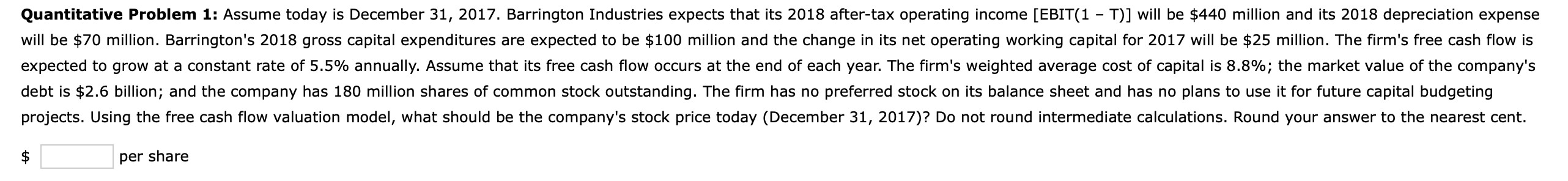

Question: Quantitative Problem 1 : Assume today is December 3 1 , 2 0 1 7 . Barrington Industries expects that its 2 0 1 8

Quantitative Problem : Assume today is December Barrington Industries expects that its aftertax operating income EBIT will be $ million and its depreciation expense

will be $ million. Barrington's gross capital expenditures are expected to be $ million and the change in its net operating working capital for will be $ million. The firm's free cash flow is

expected to grow at a constant rate of annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is ; the market value of the company's

debt is $ billion; and the company has million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting

projects. Using the free cash flow valuation model, what should be the company's stock price today December Do not round intermediate calculations. Round your answer to the nearest cent.

$ per share

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock