Question: Quantitative Problem 1: Beasley Industries' sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets

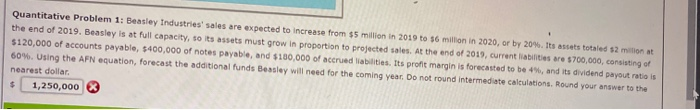

Quantitative Problem 1: Beasley Industries' sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled 52 min the end of 2019. Beasley is a full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $700,000, consisting of $120,000 of accounts payable, $400,000 of notes payable, and $100,000 of accrued abilities. Its profit margin is forecasted to be, and its dividend payout ratio is 60%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations, Round your answer to the nearest dollar 1,250,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts