Question: Quantitative Problem 1: Beasley Industries sales are expected to increase from $4 million in 2019 to $5 million in 2020, or by 25%, Its assets

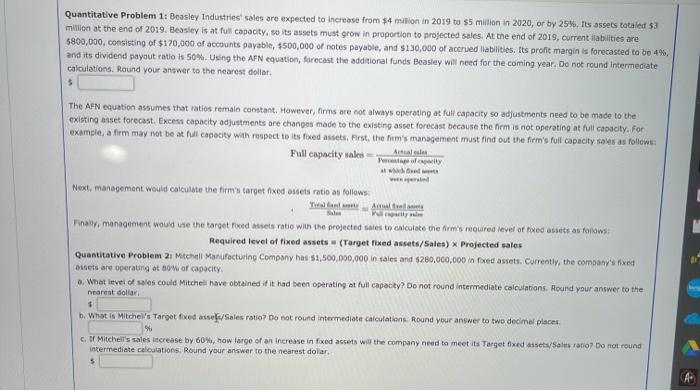

Quantitative Problem 1: Beasley Industries sales are expected to increase from $4 million in 2019 to $5 million in 2020, or by 25%, Its assets totaled 53 million at the end of 2019. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $800,000, consisting of $170,000 of accounts payable, $500,000 of notes payable, and $130,000 of accrued liabilities. Its profit margin is forecasted to be 4% and its dividend payout ratio 1 SO. Using the APN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Round your answer to the nearest dollar. 5 The AFN equation assumes that ratios remain constant. However, firms are not always operating at full capacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast because the firm is not operating at full capacity. For example, a firm may not be at full capacity with respect to its fixed assets. First, the firm's management must find out the firm's full capacity as as follows: Full capacity valerat wie Next, management would calculate the firm's target med et ratio as follows: wall Finally, management would use the target hived et ratio win the projected sales to calculate the firm's required level of wediets as follows Required level of fixed assets (Target fixed assets/Sales) x Projected sales Quantitative Problem 2. Mitchell Manufacturing Company has 54,500,000,000 in sales and $280,000,000 in foxed assets. Currently, the company's fixed sets are operating at how of capacity a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar $ b. What is Mitchells Target fixed asses/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places % c. of Mitchell's sales increase by 60%, how large of an increase in foxed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts