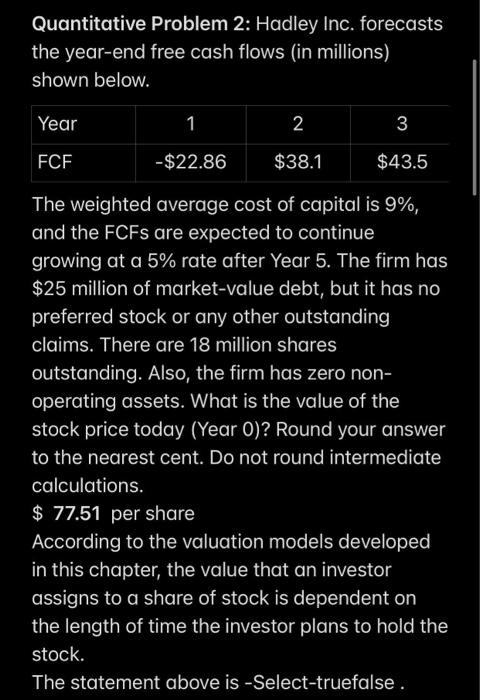

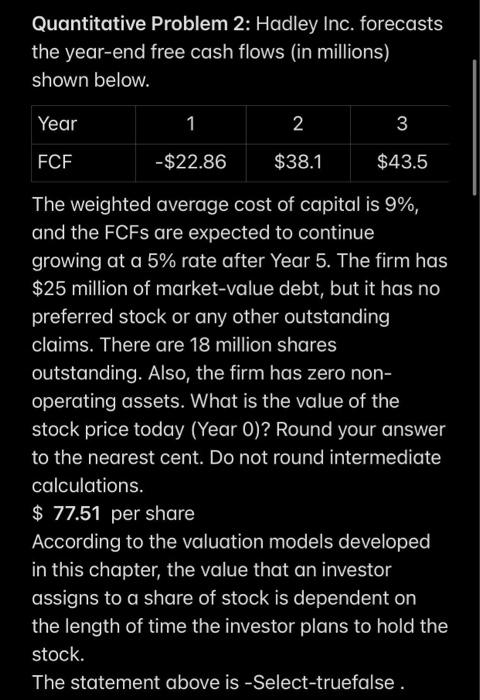

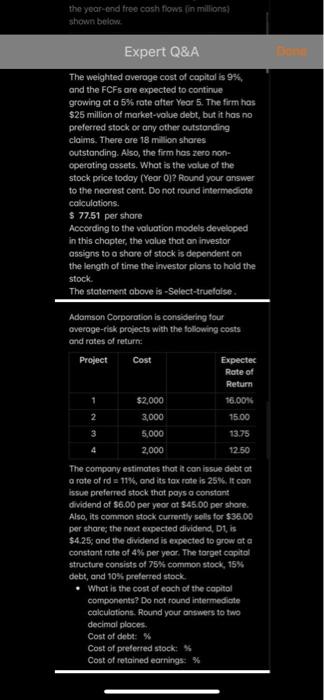

Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 FCF -$22.86 $38.1 $43.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year O)? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77.51 per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefalse. Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 FCF -$22.86 $38.1 $43.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year O)? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77.51 per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefalse. the year and free cash flows in millions shown below. Expert Q&A The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year Oj? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77,51 per shore According to the valuation models developed in this chapter, the value thot on investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefoise. Adamson Corporation is considering four overage-risk projects with the following costs and rates of return Project Cost Expecte Rate of Return $2,000 16.00% 3,000 15.00 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 11%, and its tax rate is 25%, it can issue preferred stock that pays a constant dividend of $6.00 per year of $45.00 per shore. Also, its common stock currently sells for $35.00 per share the next expected dividend, D1, is $4.25, and the dividend is expected to grow at a constant rate of 4% per year. The forget capital structure consists of 75% common stock, 15% debt, and 10% preferred stock What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: % Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 FCF -$22.86 $38.1 $43.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year O)? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77.51 per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefalse. Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 FCF -$22.86 $38.1 $43.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year O)? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77.51 per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefalse. the year and free cash flows in millions shown below. Expert Q&A The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year Oj? Round your answer to the nearest cent. Do not round intermediate calculations. $ 77,51 per shore According to the valuation models developed in this chapter, the value thot on investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select-truefoise. Adamson Corporation is considering four overage-risk projects with the following costs and rates of return Project Cost Expecte Rate of Return $2,000 16.00% 3,000 15.00 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 11%, and its tax rate is 25%, it can issue preferred stock that pays a constant dividend of $6.00 per year of $45.00 per shore. Also, its common stock currently sells for $35.00 per share the next expected dividend, D1, is $4.25, and the dividend is expected to grow at a constant rate of 4% per year. The forget capital structure consists of 75% common stock, 15% debt, and 10% preferred stock What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: % Cost of preferred stock: % Cost of retained earnings: %