Question: Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 4 5 FCF -$22.91 $38.1

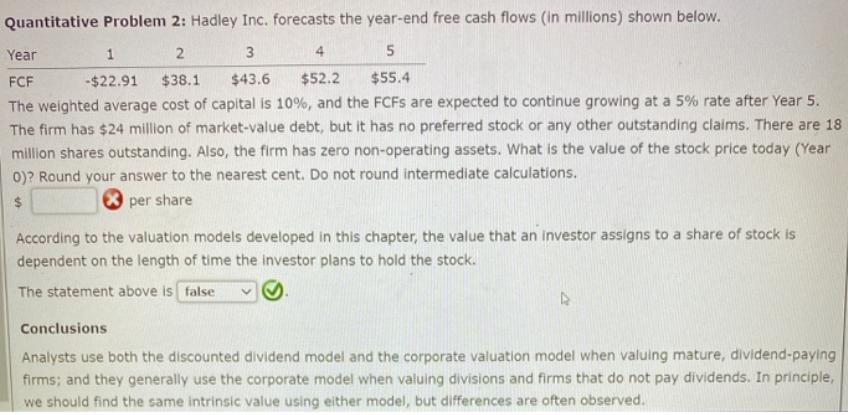

Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year 1 2 3 4 5 FCF -$22.91 $38.1 $43.6 $52.2 $55.4 The weighted average cost of capital is 10%, and the FCFS are expected to continue growing at a 5% rate after Year 5. The firm has $24 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 18 million shares outstanding. Also, the firm has zero non-operating assets. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations. $ per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is false Conclusions Analysts use both the discounted dividend model and the corporate valuation model when valuing mature, dividend-paying firms; and they generally use the corporate model when valuing divisions and firms that do not pay dividends. In principle, we should find the same intrinsic value using either model, but differences are often observed.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

In here FCF of 5 year554 Growth rate05 WACC010 Value after year 5 554 1050100055... View full answer

Get step-by-step solutions from verified subject matter experts