Question: Quantitative Problem 3: Assume today is December 31, 2018. Imagine Works Inc. just paid a dividend of $1.40 per share at the end of 2018

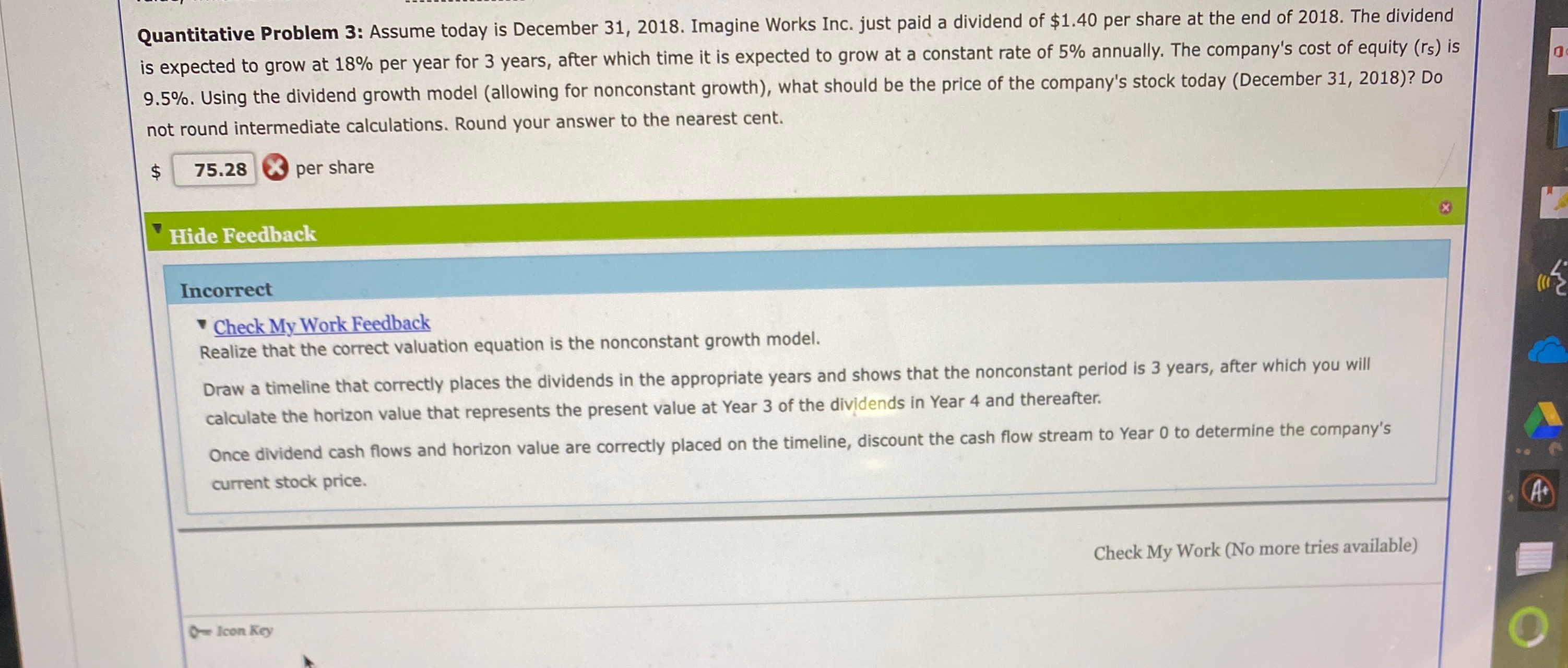

Quantitative Problem 3: Assume today is December 31, 2018. Imagine Works Inc. just paid a dividend of $1.40 per share at the end of 2018 . The dividend is expected to grow at 18% per year for 3 years, after which time it is expected to grow at a constant rate of 5% annually. The company's cost of equity ( rs ) is 9.5%. Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 31,2018 )? Do not round intermediate calculations. Round your answer to the nearest cent. per share Hide Feedback Incorrect - Check My Work Feedback Realize that the correct valuation equation is the nonconstant growth model. Draw a timeline that correctly places the dividends in the appropriate years and shows that the nonconstant period is 3 years, after which you will calculate the horizon value that represents the present value at Year 3 of the dividends in Year 4 and thereafter. Once dividend cash flows and horizon value are correctly placed on the timeline, discount the cash flow stream to Year 0 to determine the company's current stock price. Check My Work (No more tries available)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts