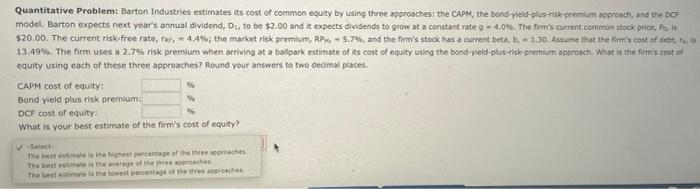

Question: Quantitative Problem: Barton Indistries estimates its cost of common equity by using three approachest the CapM, the bond-yield-plus-risk-premium apprach, and the DCF model. Barton expects

Quantitative Problem: Barton Indistries estimates its cost of common equity by using three approachest the CapM, the bond-yield-plus-risk-premium apprach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2,00 and it expects dividends to grow at a constant rate g=4,046. The firm's carrent common stock price, Per is 13.49\%. The firm uses a 2.7% risk premium when arriving ot a ballpark estimste of its cost of equity wing the bond-vield-plus-risk-premium opprosch. What is the firmit cott of equity using each of these three approaches? Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock