Question: Quantitative Problem: Barton Industries expects next year's annual dividend, Du, to be $1.60 and it expects dividends to grow at a constant rate g -

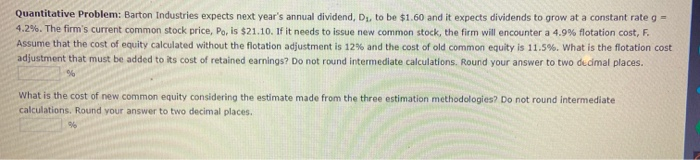

Quantitative Problem: Barton Industries expects next year's annual dividend, Du, to be $1.60 and it expects dividends to grow at a constant rate g - 4.2%. The firm's current common stock price, Po, is $21.10. If it needs to issue new common stock, the firm will encounter a 4.9% flotation cost, F. Assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. What is the flotation cost adjustment that must be added to its cost of retained earnings? Do not round intermediate calculations, Round your answer to two decimal places. What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts