Question: Quantitative Problem: Barton industries expects that its target capital structure for raising funds in the future for lts capitai budget will consist of 40% debt,

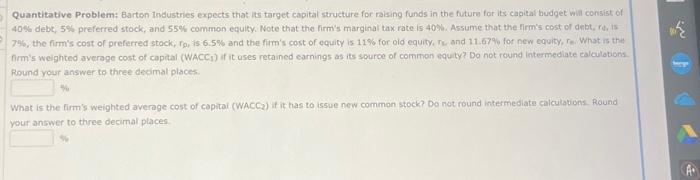

Quantitative Problem: Barton industries expects that its target capital structure for raising funds in the future for lts capitai budget will consist of 40% debt, 5% preferred stock; and 55 \% common equity, Note that the firm's marginal tax rate is 40 ohi, Assumie that the firm's cost of debt, fi, is 7\%6, the firm's cost of preferred stock, rap is 6.5% and the firm's cost of equity is 11% for old equity, ru, and 11.67% for new equity, re. What is the firm's weighted syerage cost of copital (WACC, ) if it uses retained earnings as its spurce of common equity? Do not round intermediate ealculations Round your answer to three decimal places. What is the firm's weighted average cost of copitai (WAcCy) if it has to issue new common stock? Do not round inkermediate calculations. Round your answer to three decirnal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts