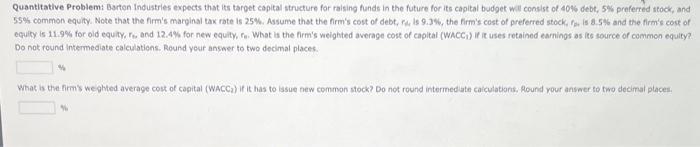

Question: Quantitative Problem: Barton industries expects that its target copital structure for ralsing funds in the future for its capital budget will consist of 4016 debt,

Quantitative Problem: Barton industries expects that its target copital structure for ralsing funds in the future for its capital budget will consist of 4016 debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, ry is 9.3%, the firm's cost of preferred stock, fat is 8.5%6 and the firm's cock of equity is 11.9% for oid equity, r6 and 12.4% for new equity. F. What is the firm's weighted average cost of capital (WacCi) if it uses retained earnings as ite source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. What is the firms weghted average cost of cepital (WACC 3 ) if it has to issue new common stock? Do not round intermed ate caiculations. Plound your ansmer to two dedmal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts