Question: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects'

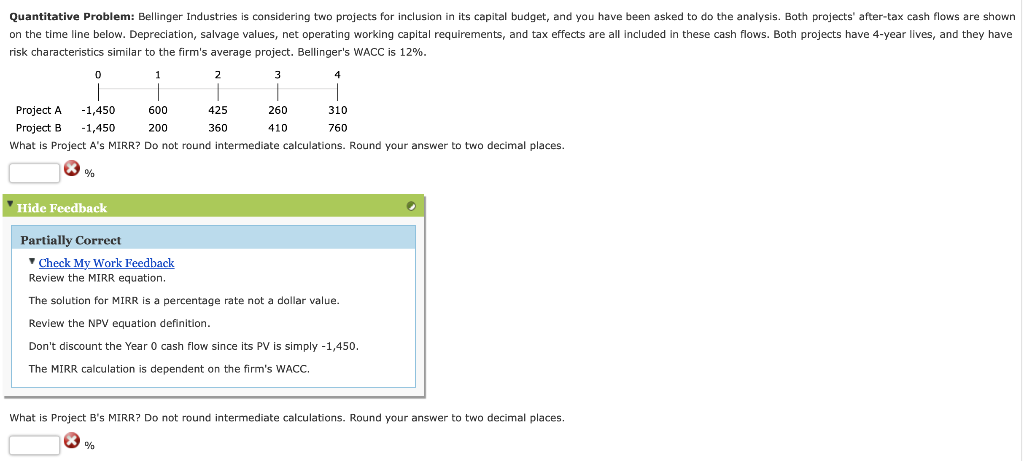

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 12%. 1 2 3 4 Project A -1,450 600 425 260 310 Project B -1,450 200 360 410 760 What is Project A's MIRR? Do not round intermediate calculations. Round your answer to two decimal places. % Hide Feedback Partially Correct Check My Work Feedback Review the MIRR equation. The solution for MIRR is a percentage rate not a dollar value. Review the NPV equation definition. Don't discount the Year 0 cash flow since its PV is simply -1,450. The MIRR calculation is dependent on the firm's WACC. What is Project B's MIRR? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts