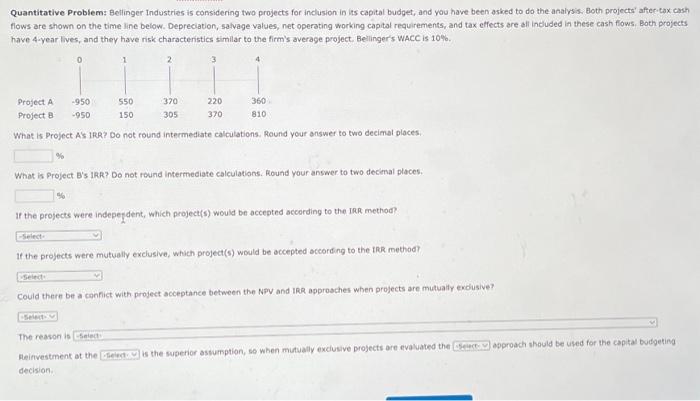

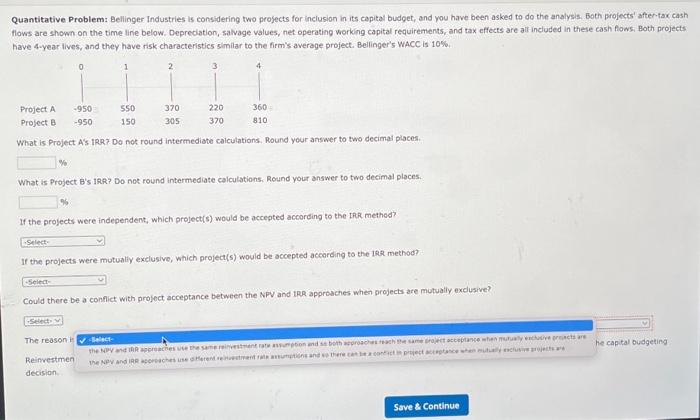

Question: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis, Both projects'

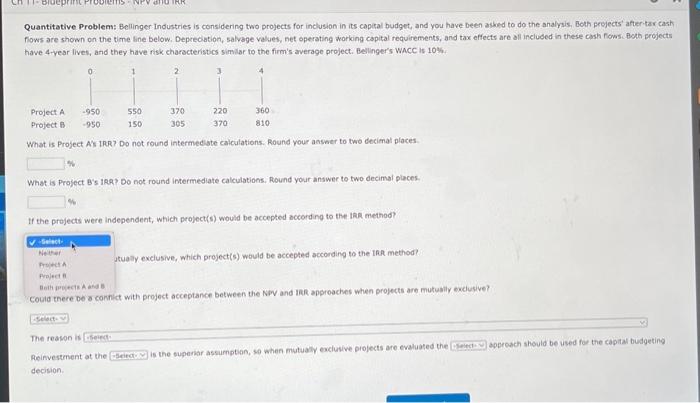

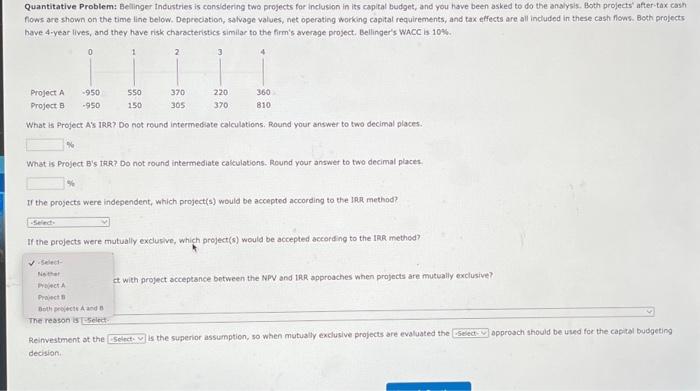

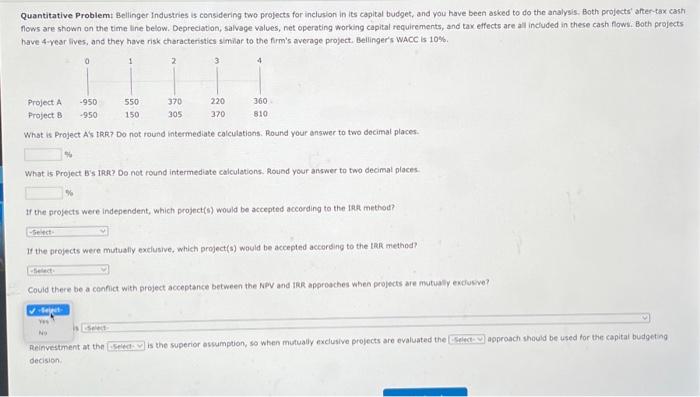

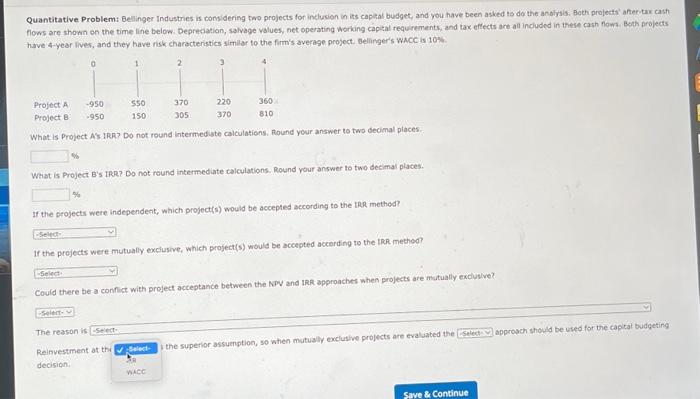

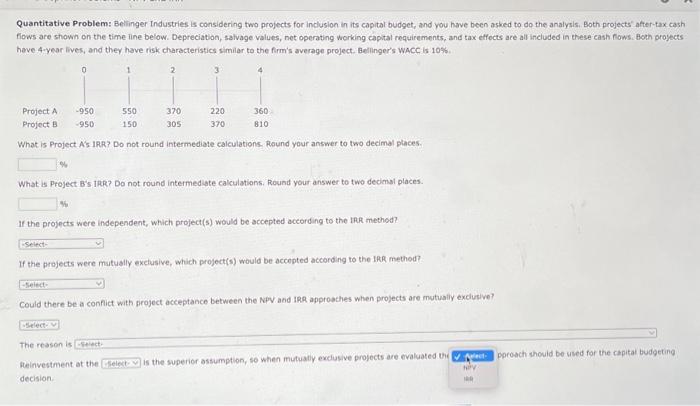

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis, Both projects' aftectax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capitat requirements, and tax effects are aff induded in these eash fiows, Bath projects have 4 -year lives, and they have risk characteristics similar to the firm's average project. Bellinger's wACC is 10%. What is Project As IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were indepefdent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted occording to the the method? Could there bef a confict with project scceptance between the NPV and IRR approsches when projects are mutualf evolusive? The reason is Geiecte Dieinvestment ot the is the superior aswumption, so when mustually exclusive projects are evaluated the approach should be used for the capital budgeting decision. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capical budget, and you have been ashed to do the analysis, Both projects' after tar cash flows are shown on the time tine below. Depredation, salvage values, net operating working capital requirements, and tax effects are all included in these cash fiows. Both projects have 4 -year lives, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 10%. What is Project As IRR? Do not round intermedste calculations. Round vour answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the tak method? Itually exciusive, which project(s) would be accepted according to the IRR method? Could there be o connict with project acceptance between the NPV and IRR approaches when projects are mutusily exdusive? The reavon is cosects Reinvestrnent at the is the supenar assumption, so when mutualy exclusive piofects are evaluated the approach should be used foe the capiral budgeting decision. Quantitative Problem: Bellinger Industries is cansidering two projects for inclusion in its capital budget, and you fuve been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Boch projects have 4 -year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 104. What is Profect A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's thR? Do not round intermediate calculations. Round your anawer to two decimal placks. \%) If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exdusive, which project(s) would be accepted sccording to the IRR method? At with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? Reinvestment of the is the superior assumption, so when mutually exclusive projects are evaluated the approach should be used for the capital budgetion Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis, Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash fows: Both projects have 4 -year lives, and they have risk characteristics similar to the firm's average project, Bellinger's WACC is 10%. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Deprediation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows, Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 10%. What is Project A's 1RR? Do not round intermediate calculations. Round your answer to two decimal places. W What is Project B's IRR? Do not round intermediate calculations, Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the trR method? If the projects were mutually exclusive, which project(s) would be occepted according to the 192 method? Could there be a conflict with profect acceptance between the NPV and IRR approaches when projects are mutualiy exclusive? Quantitative Problem: Bellinger Industnes is considering two projects for inclusion in its captal budget, and you have been asked to do the anolysis. Both projects' anter-ax cash Flows are shown on the time line below. Deprecotion, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects What is Project As IRR> Do not round intermed ste calculations. Round your answer to two decimal places: What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the tRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR-method? Could there be a confict with project acceptance between the NPV and IRR approaches when projects are motually excluslve? The reason is -seiect: Reinvestment at the The superior assumption, 50 whien mutualiv excluswe projects are evaluated the approach should be used for the captat budgeting decision. Quantitative Problem: Belinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-taxcash fiows are showh on the time line below. Depreciation, salvage values, net operating working capitat requirements, and tax effects are alf included in these cash fows. Both proyects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 10%. What is Project A's IRR? Do not round intermediate calculations, Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. Wh If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and iRR approaches when projects are mutually exclusive? The reason is Cereiect. thainvestment at the is the superior ossumption, so when mutuady exclusve profects are evaluated thi porouch should be used for the capitar budgeting decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts