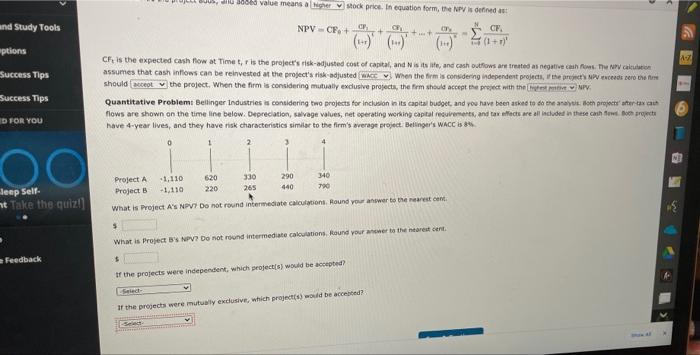

Question: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects'

and Study Tools *(1+)' aptions 17 Success Tips uus, sed value means a Higher stock price. In equation form, the NPV is defined as NPV - CF + + OF CF. + (...) CF, is the expected cash flow at Timet, is the project's risk-adjusted cost of capital, and is site, and cash outflows are treated as negative cho PVC assumes that cash inflows can be reinvested at the project's risk-adjusted me when the firm's considering independent projects, the precederos should be the project. When the firm is considering mutually exclusive projects, the firm should accepterect with the rest NPV. Quantitative Problemi Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the anay. Ho projecte afer tax caus flows are shown on the timeline below. Depreciation, salvage values, net operating werking capital recurements, and tax effects are all included in these canshow foreca have 4-year lives, and they have risk characteristics similar to the firm's average project. Betinger's WACC 68% 0 1 2 Success Tips D FOR YOU 4 220 deep Self- at Take the quiz! Project A -1,110 620 330 290 340 Projects -1.110 265 440 700 What is Project A's NPV7 Do not round intermediate calculation Round your answer to the rest cant 5 What is Project B's NPV? Do not und intermediate calculations, Round your answer to the nearest der Feedback $ If the projects were independent, which project(s) would be accepted? of the projects were mutually exclusive, which project(s) would be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts