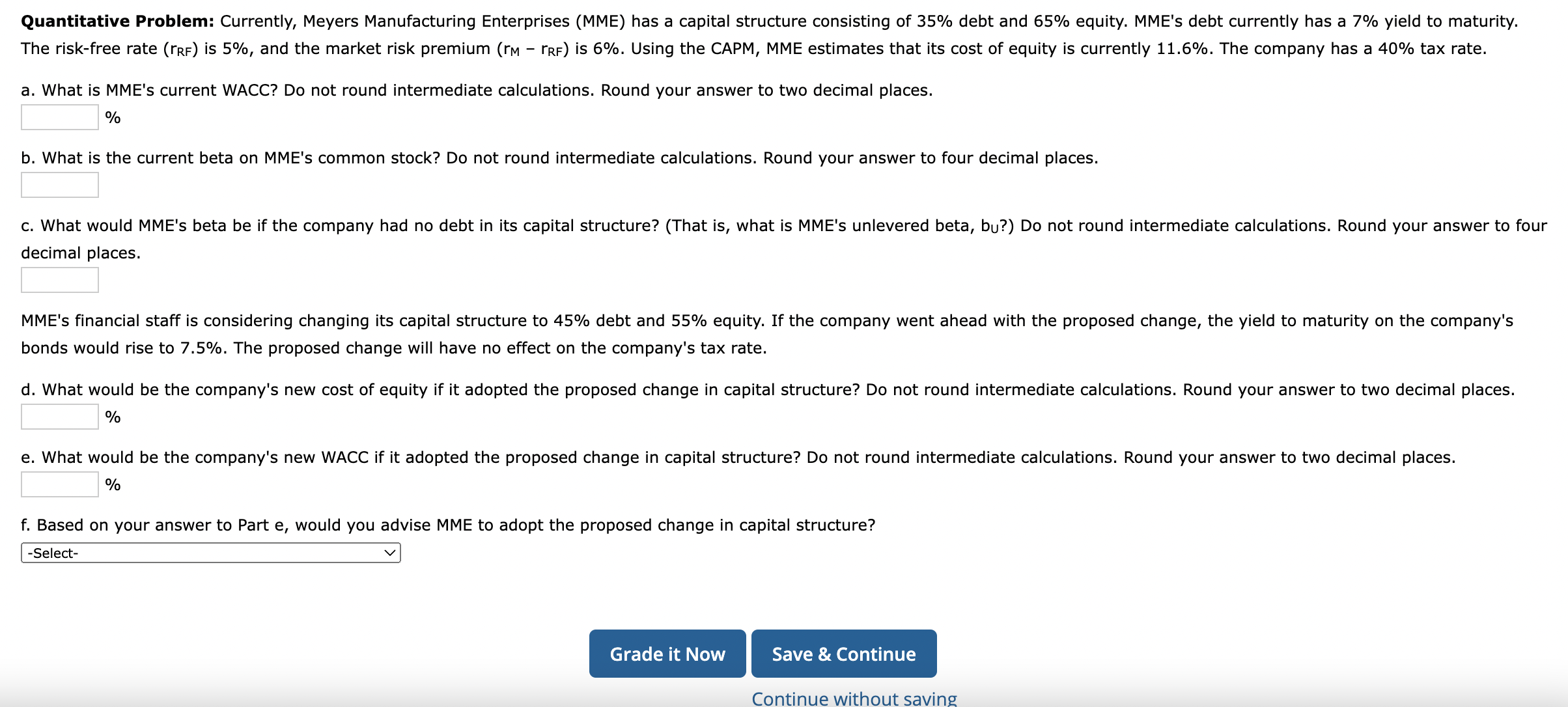

Question: Quantitative Problem: Currently, Meyers Manufacturing Enterprises ( MME ) has a capital structure consisting of 3 5 % debt and 6 5 % equity. MME's

Quantitative Problem: Currently, Meyers Manufacturing Enterprises MME has a capital structure consisting of debt and equity. MME's debt currently has a yield to maturity.

The riskfree rate is and the market risk premium is Using the CAPM, MME estimates that its cost of equity is currently The company has a tax rate.

a What is MME's current WACC? Do not round intermediate calculations. Round your answer to two decimal places.

b What is the current beta on MME's common stock? Do not round intermediate calculations. Round your answer to four decimal places.

c What would MME's beta be if the company had no debt in its capital structure? That is what is MME's unlevered beta, bu Do not round intermediate calculations. Round your answer to four

decimal places.

MME's financial staff is considering changing its capital structure to debt and equity. If the company went ahead with the proposed change, the yield to maturity on the company's

bonds would rise to The proposed change will have no effect on the company's tax rate.

d What would be the company's new cost of equity if it adopted the proposed change in capital structure? Do not round intermediate calculations. Round your answer to two decimal places.

e What would be the company's new WACC if it adopted the proposed change in capital structure? Do not round intermediate calculations. Round your answer to two decimal places.

f Based on your answer to Part e would you advise MME to adopt the proposed change in capital structure?

Select

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock