Question: Quantitative Problem: Rosnan Industries' 2013 and 2012 balance sheets and income statements are shown below. The balance in the firm's cash and equivalents account is

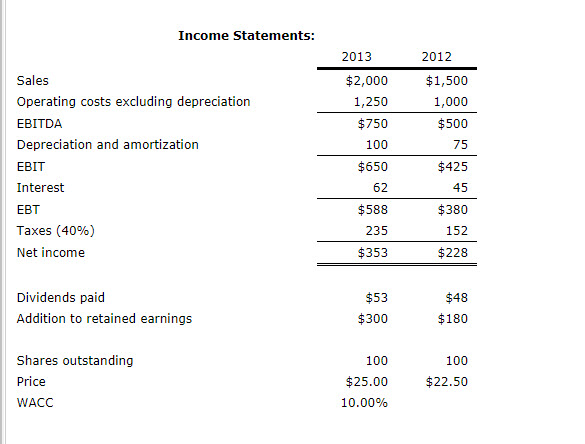

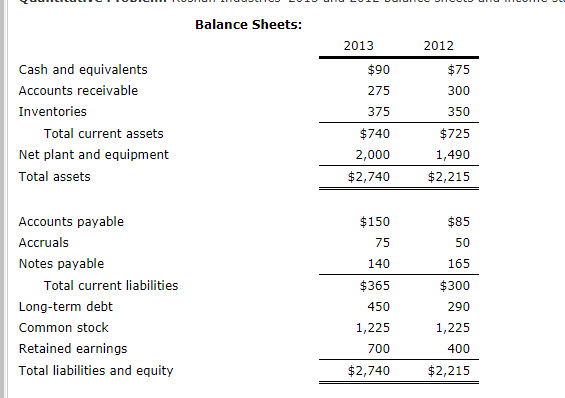

Quantitative Problem: Rosnan Industries' 2013 and 2012 balance sheets and income statements are shown below.

The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash.

What is Rosnan's 2013 net operating working capital (NOWC)? $

What is Rosnan's 2013 net working capital (NWC)? $

Income Statements: 2013 2012 Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest EBT Taxes (40%) Net income $2,000 1,250 $750 100 $650 62 $588 235 $353 $1,500 1,000 $500 75 $425 $380 152 $228 Dividends paid Addition to retained earnings $53 $300 $48 $180 Shares outstanding Price WACC 100 $25.00 10.00% 100 $22.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts