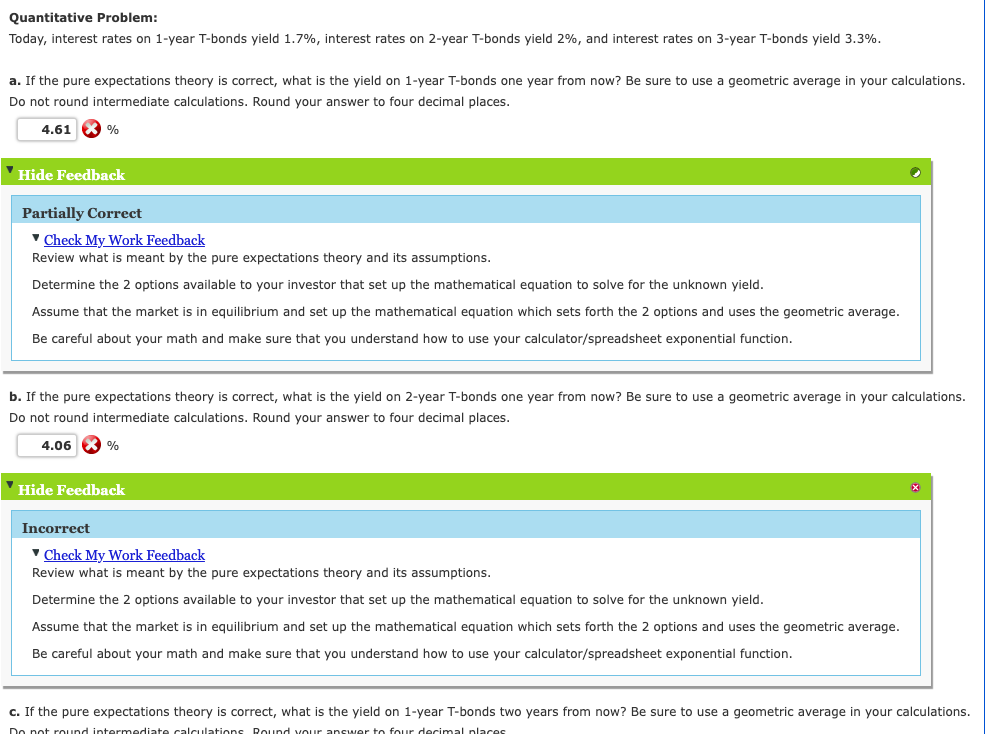

Question: Quantitative Problem: Today, interest rates on 1 -year T-bonds yield 1.7%, interest rates on 2 -year T-bonds yield 2%, and interest rates on 3 -year

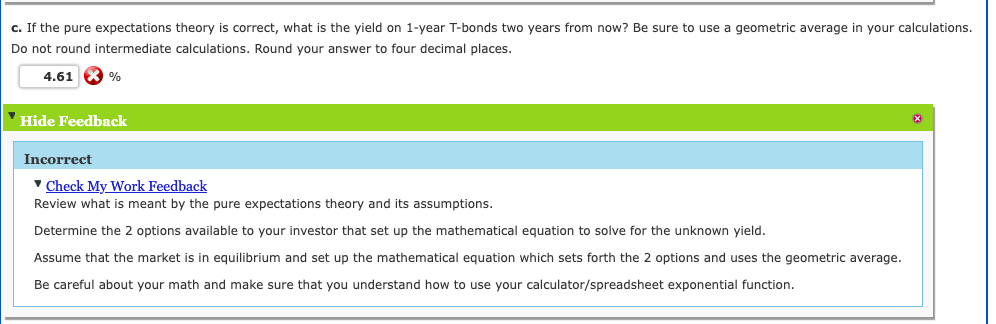

Quantitative Problem: Today, interest rates on 1 -year T-bonds yield 1.7%, interest rates on 2 -year T-bonds yield 2%, and interest rates on 3 -year T-bonds yield 3.3. Do not round intermediate calculations. Round your answer to four decimal places. (3) % Hide Feedback Partially Correct Check My Work Feedback Review what is meant by the pure expectations theory and its assumptions. Determine the 2 options available to your investor that set up the mathematical equation to solve for the unknom Assume that the market is in equilibrium and set up the mathematical equation which sets forth the 2 options and the Do not round intermediate calculations. Round your answer to four decimal places. Hide Feedback Incorrect Vheck My Work Feedback Review what is meant by the pure expectations theory and its assumptions. Assume that the market is in equilibrium and set up the mathematical equation which sets forth the 2 options and uses the geometric average. Be careful about your math and make sure that you understand how to use your calculator/spreadsheet exponential function. no not rnind intormodiate ralrulatinne Dnnd vonr ancwar th four dorimal nlaroc c. If the pure expectations theory is correct, what is the yield on 1 -year T-bonds two years from now? Be sure to use a geometric average in your calculation Do not round intermediate calculations. Round your answer to four decimal places. % Hide Feedback Incorrect Vheck My Work Feedback Review what is meant by the pure expectations theory and its assumptions. Assume that the market is in equilibrium and set up the mathematical equation which sets forth the 2 options and uses the geometric

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts