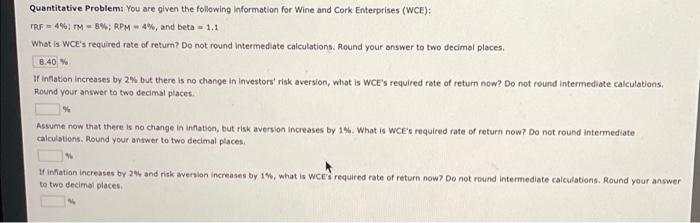

Question: Quantitative Problem. You are given the following information for Wine and Cork Enterprises (WCE): TRF-4% TM -8% RPM - 4%, and beta = 1.1 What

Quantitative Problem. You are given the following information for Wine and Cork Enterprises (WCE): TRF-4% TM -8% RPM - 4%, and beta = 1.1 What is we's required rate of return? Do not round Intermediate calculations. Round your answer to two decimal places 8.40% if inflation Increases by 29 but there is no change in Investors' rink a version, what is we's required rate of return now? Do not round Intermediate calculations Round your answer to two decimal places Assume now that there is no change in Inflation, but risk aversion increases by 1 What is we's required rate of return now? Do not round Intermediate calculations. Round your answer to two decimal places If nation increases by 24 and risk version increases by 1%, what is wel required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts