Question: Quantltative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects'

Quantltative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' aftertax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is

What is Project As IRR? Do not round intermediate calculations. Round your answer to two decimal places.

Hide Feedback

Partially Correct

Check My Work Feedback

Review the IRR equation.

The solution for IRR is a percentage rate not a dollar value.

The IRR calculation is not dependent on the firm's WACC.

Don't forget the minus sign for thf: Year cash flow.

Don't forget to include the Year cash flow in your calculation.

What is Project Bs IRR? Do not round intermediate calculations. Round your answer to two decimal places.

Hide Feedback

Incorrect

Check My Work Feedback

Review the IRR equation.

The solution for IRR is a percentage rate not a dollar value.

The IRR calculation is not dependent on the firm's WACC.

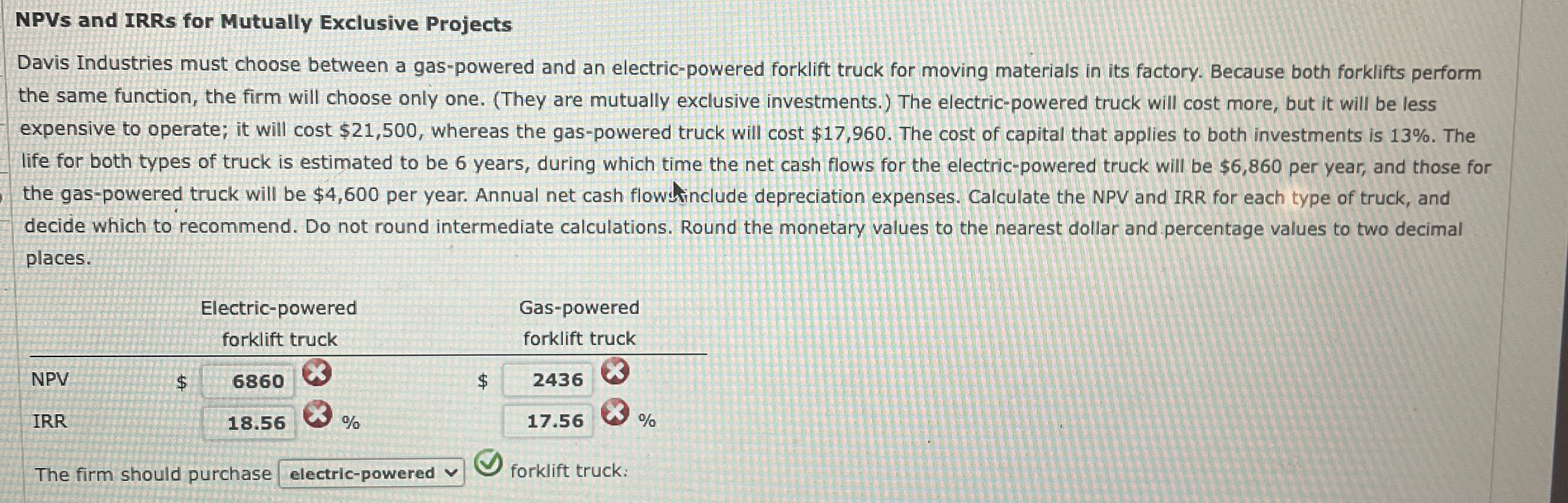

NPVs and IRRs for Mutually Exclusive Projects

Davis Industries must choose between a gaspowered and an electricpowered forklift truck for moving materials in its factory. Because both forklifts perform

the same function, the firm will choose only one. They are mutually exclusive investments. The electricpowered truck will cost more, but it will be less

expensive to operate; it will cost $ whereas the gaspowered truck will cost $ The cost of capital that applies to both investments is The

life for both types of truck is estimated to be years, during which time the net cash flows for the electricpowered truck will be $ per year, and those for

the gaspowered truck will be $ per year. Annual net cash flowstinclude depreciation expenses. Calculate the NPV and IRR for each type of truck, and

decide which to recommend. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal

places.

The firm should purchase

forklift truck:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock