Question: Quantum 'R Us has a physics research lab which would like to use a specialized machine for its quantum computers research program. The company will

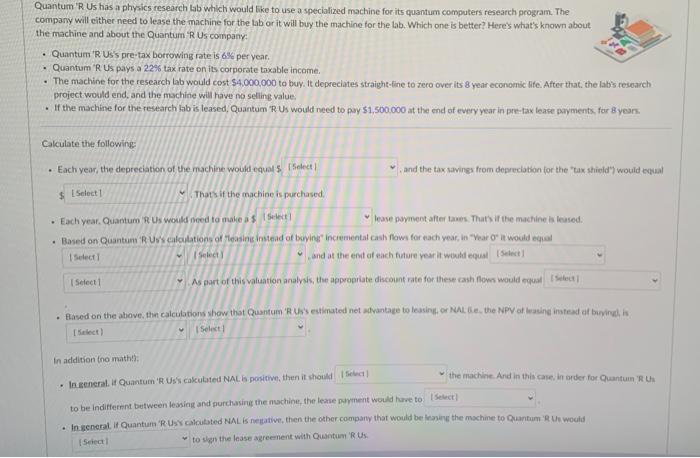

Quantum 'R Us has a physics research lab which would like to use a specialized machine for its quantum computers research program. The company will either-need to lease the machine for the tab or it will buy the machine for the lab. Which one is better? Heres what's known about the machine and about the Quanturn 'R US company? - Quantum 'R US's pre-tax borrowing rate is 6es per year. - Quantum 'R Us pays a 22% tax rate on its corporate taxable income. - The machine for the research lab would cost $4,000,000 to buy. It depreciates straight-fine to zero over its 8 year economic life. After that, the labis research project would end, and the machine will have no seling value; - If the machine for the research lab is leased, Quantum "R Us would need to pay 51,500.000 at the end of every year in pre-tax lease payments. for 8 yeans. Calculate the following - Each year, the depreciation of the machine would equal 5 and the tax savings from depreciabion for the "tax shield"7 would ecoal That's if the machine is purchased. - Each year. Quantum RR Us would need to make a 5 lease payment after baes. Thats if the machine is leased. - Based on Guantum 'R Us's calculations of tleasine instead af boying" incienental cash fows for nach year, in "Year o' it would ecasal and at the ent of each fudsie year it woukd equal As part of this valuation analysis, the appropriate discount rate for these cash floms would cqual In addition tho math!). - In eenernal, it Quantum 'R Us's cakulated NAL is positive, then it should to be indifferent between lessing and purchasing the nuchine, the lease phyment would hare to to sign the lease agreernent with Quantum 'R Us: Quantum 'R Us has a physics research lab which would like to use a specialized machine for its quantum computers research program. The company will either-need to lease the machine for the tab or it will buy the machine for the lab. Which one is better? Heres what's known about the machine and about the Quanturn 'R US company? - Quantum 'R US's pre-tax borrowing rate is 6es per year. - Quantum 'R Us pays a 22% tax rate on its corporate taxable income. - The machine for the research lab would cost $4,000,000 to buy. It depreciates straight-fine to zero over its 8 year economic life. After that, the labis research project would end, and the machine will have no seling value; - If the machine for the research lab is leased, Quantum "R Us would need to pay 51,500.000 at the end of every year in pre-tax lease payments. for 8 yeans. Calculate the following - Each year, the depreciation of the machine would equal 5 and the tax savings from depreciabion for the "tax shield"7 would ecoal That's if the machine is purchased. - Each year. Quantum RR Us would need to make a 5 lease payment after baes. Thats if the machine is leased. - Based on Guantum 'R Us's calculations of tleasine instead af boying" incienental cash fows for nach year, in "Year o' it would ecasal and at the ent of each fudsie year it woukd equal As part of this valuation analysis, the appropriate discount rate for these cash floms would cqual In addition tho math!). - In eenernal, it Quantum 'R Us's cakulated NAL is positive, then it should to be indifferent between lessing and purchasing the nuchine, the lease phyment would hare to to sign the lease agreernent with Quantum 'R Us

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts