Question: Quatro Co. issues bonds dated January 1, 2019, with a par value of $810,000. The bonds' annual contract rate is 12%, and interest is paid

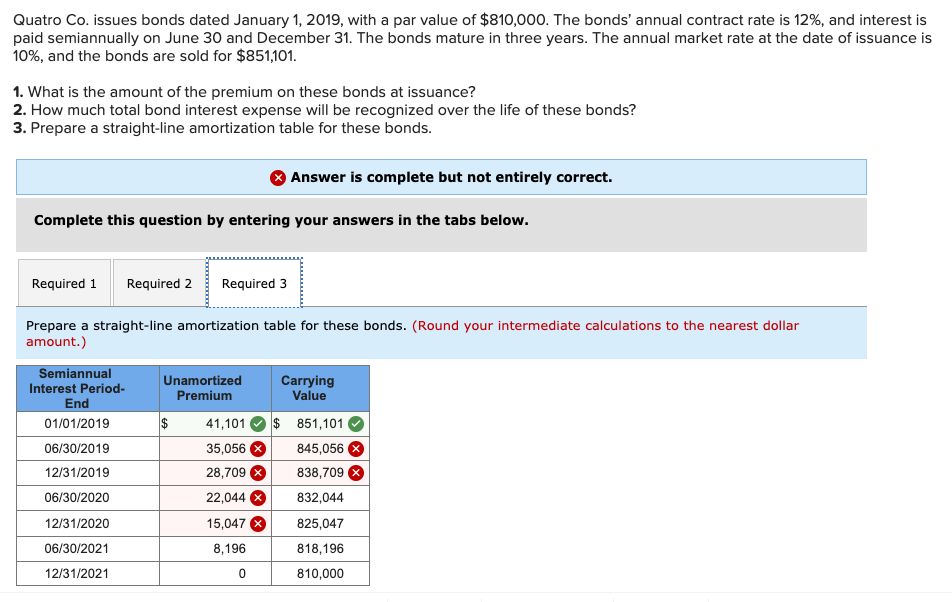

Quatro Co. issues bonds dated January 1, 2019, with a par value of $810,000. The bonds' annual contract rate is 12%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $851,101. 1. What is the amount of the premium on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a straight-line amortization table for these bonds. (Round your intermediate calculations to the nearest dollar amount.) Semiannual Interest Period- End 01/01/2019 Carrying Value 06/30/2019 Unamortized Premium $ 41,101 35,056 28,709 22,044 15,047 8,196 O $ 851,101 845,056 838,709 12/31/2019 06/30/2020 832,044 12/31/2020 825,047 818,196 06/30/2021 12/31/2021 810,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts