Question: Query 1 Query 2 Query 3 Sheffield Inc. makes unfinished bookcases that it sells for $58. Production costs are $37 variable and $10 fixed. Because

Query 1

Query 2

Query 3

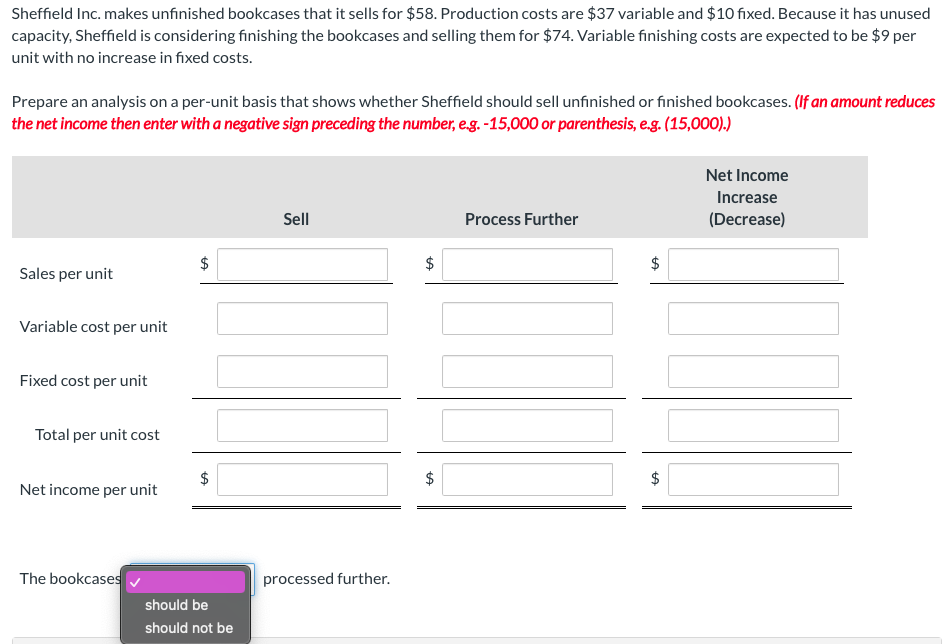

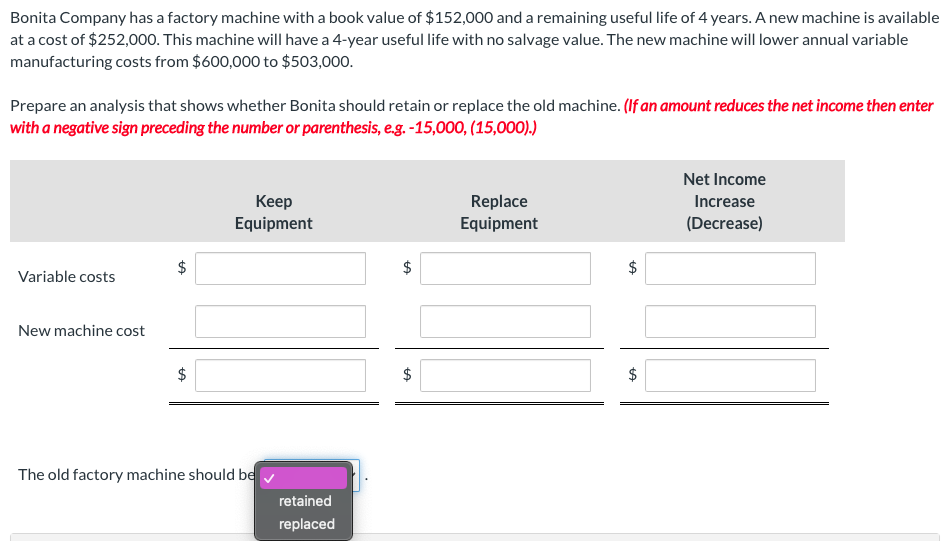

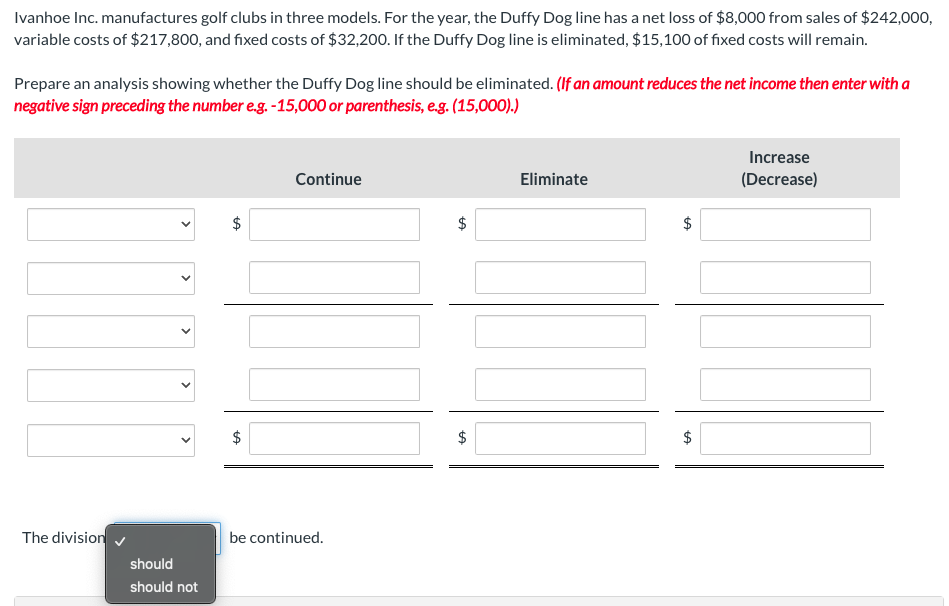

Sheffield Inc. makes unfinished bookcases that it sells for $58. Production costs are $37 variable and $10 fixed. Because it has unused capacity, Sheffield is considering finishing the bookcases and selling them for $74. Variable finishing costs are expected to be $9 per unit with no increase in fixed costs. Prepare an analysis on a per-unit basis that shows whether Sheffield should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. 15,000 or parenthesis, e.g. (15,000). Bonita Company has a factory machine with a book value of $152,000 and a remaining useful life of 4 years. A new machine is available at a cost of $252,000. This machine will have a 4-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $600,000 to $503,000. Prepare an analysis that shows whether Bonita should retain or replace the old machine. (If an amount reduces the net income then enter with a negative sign preceding the number or parenthesis, e.g. 15,000,(15,000). The old factory machine should be Ivanhoe Inc. manufactures golf clubs in three models. For the year, the Duffy Dog line has a net loss of $8,000 from sales of $242,000 variable costs of $217,800, and fixed costs of $32,200. If the Duffy Dog line is eliminated, $15,100 of fixed costs will remain. Prepare an analysis showing whether the Duffy Dog line should be eliminated. (If an amount reduces the net income then enter with a negative sign preceding the number e.g. 15,000 or parenthesis, e.g. (15,000). Ivanhoe Inc. manufactures variable costs of $217,800, Prepare an analysis showin negative sign preceding then

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts