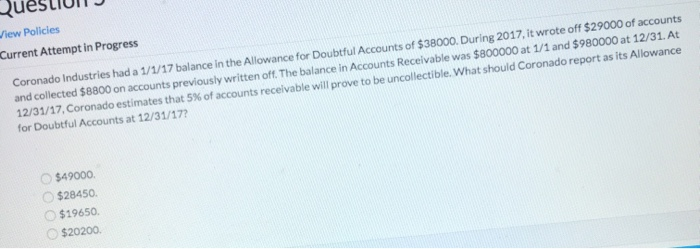

Question: QueSLIUI J View Policies Current Attempt in Progress Coronado Industries had a 1/1/17 balance in the Allowance for Doubtful Accounts of $38000. During 2017, it

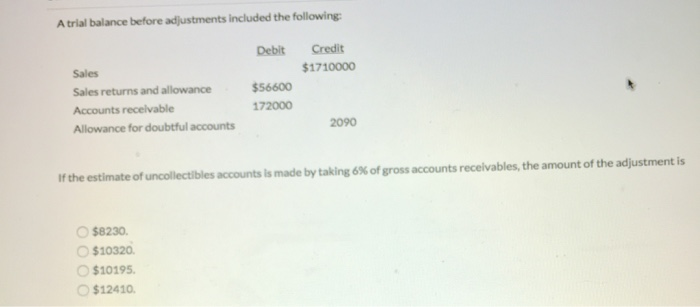

QueSLIUI J View Policies Current Attempt in Progress Coronado Industries had a 1/1/17 balance in the Allowance for Doubtful Accounts of $38000. During 2017, it wrote off $29000 of accounts and collected $8800 on accounts previously written off. The balance in Accounts Receivable was $800000 at 1/1 and $980000 at 12/31. At 12/31/17, Coronado estimates that 5% of accounts receivable will prove to be uncollectible. What should Coronado report as its Allowance for Doubtful Accounts at 12/31/17? $49000 $28450 $19650. $20200 A trial balance before adjustments included the following: Debit Credit $1710000 Sales Sales returns and allowance Accounts receivable Allowance for doubtful accounts $56600 172000 2090 if the estimate of uncollectibles account is made by taking 6% of gross accounts receivables, the amount of the adjustment is $8230 $10320 $10195 $12410

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts