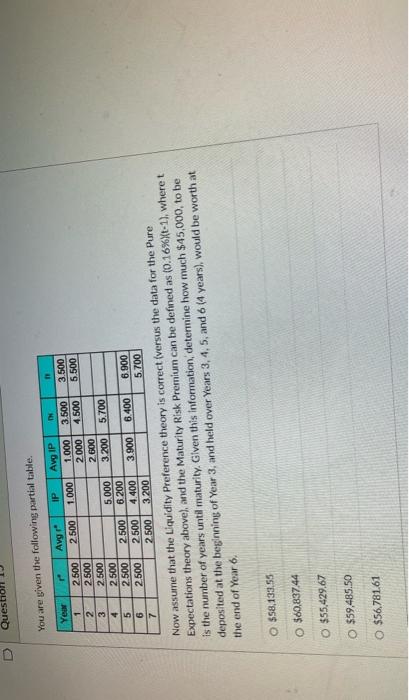

Question: Quest You are given the following partial table. Year 1 Avgr IP Avg IP IN 11 1 2.500 2.500 1.000 1.000 3.500 3.500 2.000 4.500

Quest You are given the following partial table. Year 1 Avgr IP Avg IP IN 11 1 2.500 2.500 1.000 1.000 3.500 3.500 2.000 4.500 2 2.500 5.500 3 2.500 2.600 4 2.500 5.000 3.200 5.700 5 2.500 2.500 6.200 6 2.500 2.500 4.400 6.400 3.900 6.900 7 2.500 3.200 5.700 Now assume that the Liquidity Preference theory is correct (versus the data for the Pure Expectations theory above), and the Maturity Risk Premium can be defined as (0.16% X(t-1), where t is the number of years until maturity. Given this information, determine how much $45,000, to be deposited at the beginning of Year 3, and held over Years 3, 4, 5, and 6 (4 years), would be worth at the end of Year 6. O $58,133.55 O $60,837.44 O $55,429.67 O $59.485.50 O $56.781.61 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts