Question: Question 0 4 2 0 Which statement best describes the tax treatment of tax - qualified longterm care insurance policies? Benefits paid will be taxed

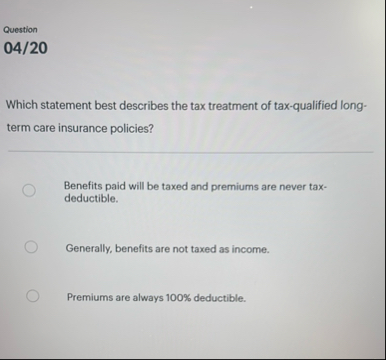

Question

Which statement best describes the tax treatment of taxqualified longterm care insurance policies?

Benefits paid will be taxed and premiums are never taxdeductible.

Generally, benefits are not taxed as income.

Premiums are always deductible.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock