Question: Question 01 (20 Marks) (Use Excel, Eviews or SPSS to obtain the required computer outputs for this Question.) Consider the investment behavior of two large

Question 01 (20 Marks)

(Use Excel, Eviews or SPSS to obtain the required computer outputs for this Question.)

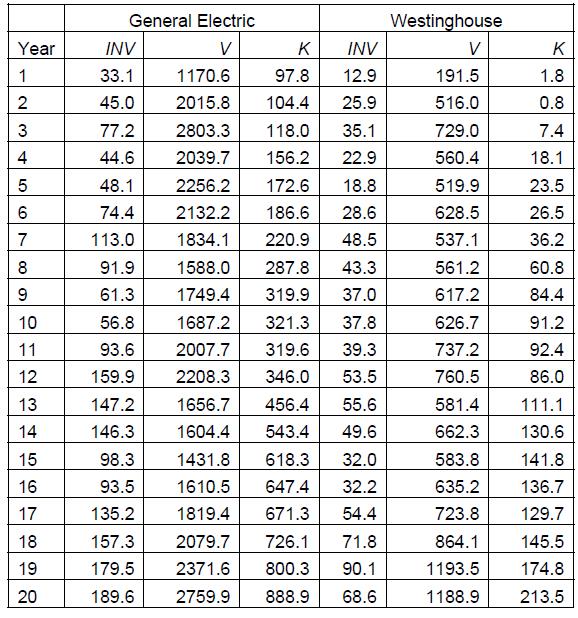

Consider the investment behavior of two large corporations, General Electric and Westinghouse. These firms compete against each other and produce many of the same types of products. We might wonder if they have similar investment strategies. Investment data for 20 years for these two corporations are given in Table 01. For each variable, the first 20 observations relate to General Electric and the last 20 observations relates to Westinghouse. The variables, for each firm, are

INV = gross investment in plant and equipment

V = value of the firm = value of common and preferred stock

K = stock of capital

A simple investment function is

INV = ?1 + ?2V + ?3K + e

If we combine, or pool, the data for both firms, we have n = 40 observations with which to estimate the parameters of the investment function. But pooling the two sources of data is valid only if the regression parameters and the variances of the error terms are the same for both corporations. If these parameters are not the same, and we combine the data sets anyway, it is equivalent to restricting the investment function

a.Estimate the investment function for the General Electric corporation. Write the estimated regression equation of the investment function in the usual format. Test for the significance of the individual coefficients as well as the overall utility of the estimated equation.

b.Estimate the investment function for the firm, Westinghouse. Write the estimated regression equation of the investment function in the usual format. Test for the significance of the individual coefficients as well as the overall utility of the estimated equation.

c.Estimate the investment function assuming that the coefficients are the same for both firms and pooling the data from both firms. Write the estimated regression equation of the investment function in the usual format. Interpret the coefficient estimates. Test for the significance of the individual coefficients as well as the overall utility of the estimated equation.

d.

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts