Question: Question 01 The new credit card system that involves customers typing in a pin number to a card reader is now a legal requirement for

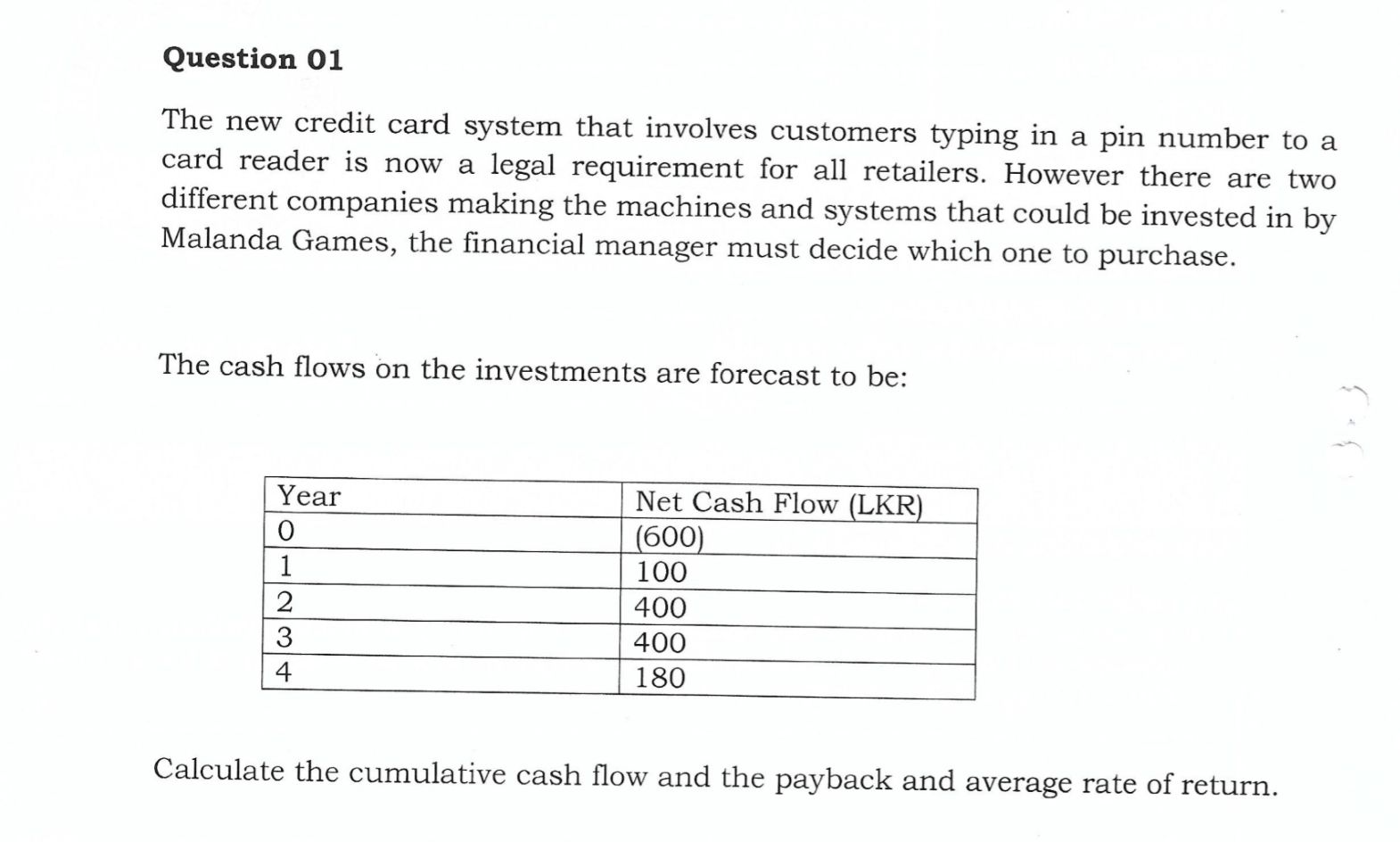

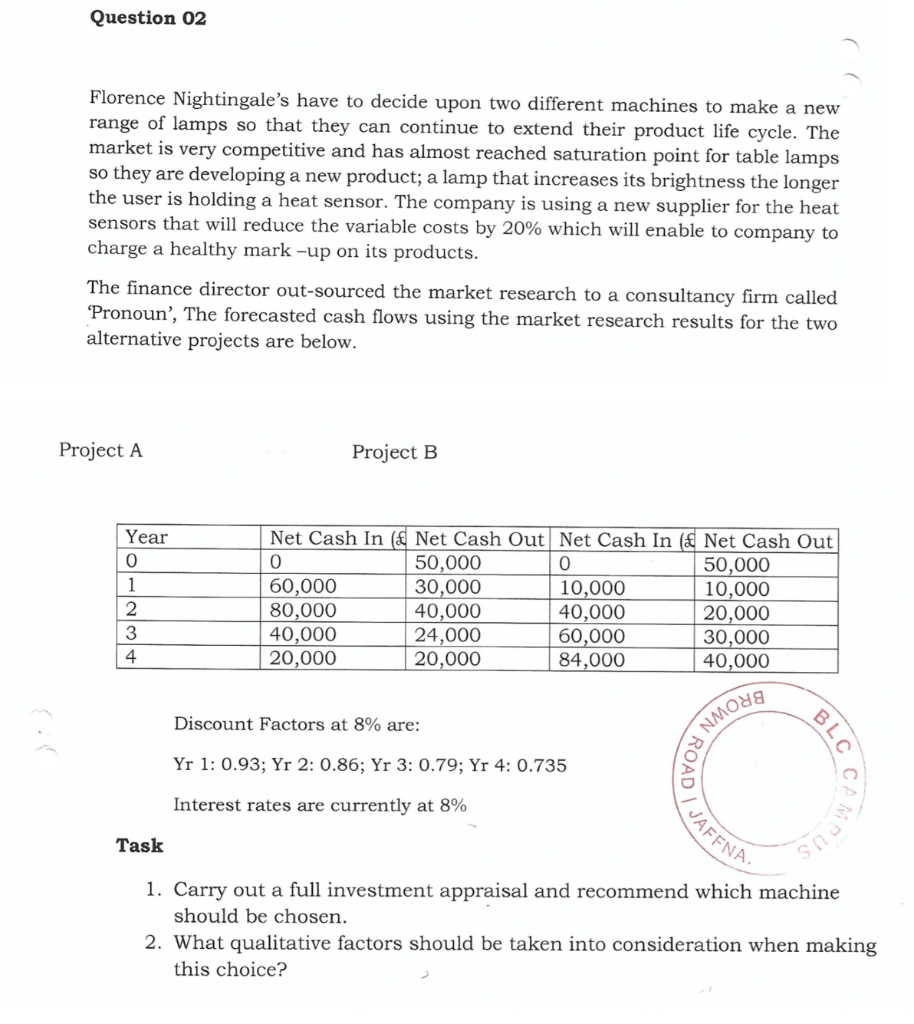

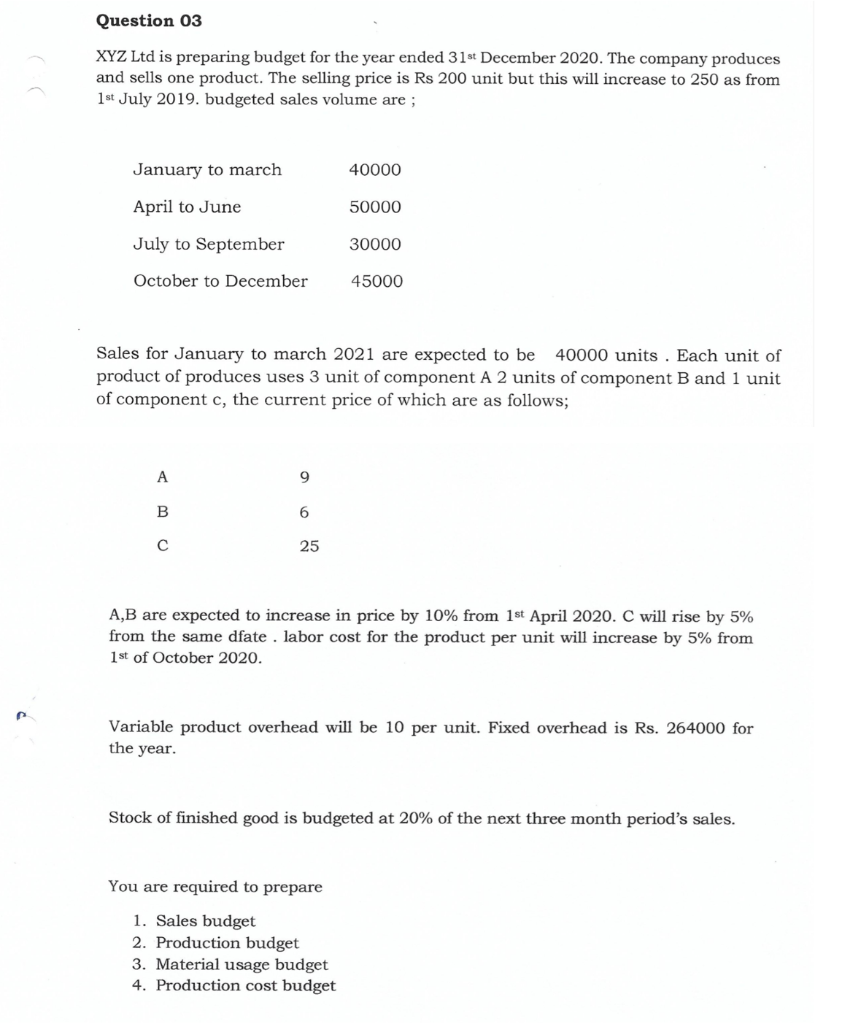

Question 01 The new credit card system that involves customers typing in a pin number to a card reader is now a legal requirement for all retailers. However there are two different companies making the machines and systems that could be invested in by Malanda Games, the financial manager must decide which one to purchase. The cash flows on the investments are forecast to be: Year Net Cash Flow (LKR) | (600) 100 400 400 180 Calculate the cumulative cash flow and the payback and average rate of return. Question 02 Florence Nightingale's have to decide upon two different machines to make a new range of lamps so that they can continue to extend their product life cycle. The market is very competitive and has almost reached saturation point for table lamps so they are developing a new product; a lamp that increases its brightness the longer the user is holding a heat sensor. The company is using a new supplier for the heat sensors that will reduce the variable costs by 20% which will enable to company to charge a healthy mark-up on its products. The finance director out-sourced the market research to a consultancy firm called Pronoun', The forecasted cash flows using the market research results for the two alternative projects are below. Project A Project B Year O Net Cash In Net Cash Out Net Cash In (& Net Cash Out 50,000 50,000 60,000 30,000 10,000 10,000 80,000 40,000 40,000 20,000 40,000 24,000 60,000 30,000 20,000 20,000 84,000 40,000 Discount Factors at 8% are: ANMoya BLC Yr 1: 0.93; Yr 2: 0.86; Yr 3: 0.79; Yr 4: 0.735 ADS Interest rates are currently at 8% AFFNA Task 1. Carry out a full investment appraisal and recommend which machine should be chosen. 2. What qualitative factors should be taken into consideration when making this choice? Question 03 XYZ Ltd is preparing budget for the year ended 31st December 2020. The company produces and sells one product. The selling price is Rs 200 unit but this will increase to 250 as from 1st July 2019. budgeted sales volume are ; January to march 40000 April to June 50000 July to September 30000 October to December 45000 Sales for January to march 2021 are expected to be 40000 units . Each unit of product of produces uses 3 unit of component A 2 units of component B and 1 unit of component c, the current price of which are as follows; A,B are expected to increase in price by 10% from 1st April 2020. C will rise by 5% from the same dfate . labor cost for the product per unit will increase by 5% from 1st of October 2020. Variable product overhead will be 10 per unit. Fixed overhead is Rs. 264000 for the year. Stock of finished good is budgeted at 20% of the next three month period's sales. You are required to prepare 1. Sales budget 2. Production budget 3. Material usage budget 4. Production cost budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts