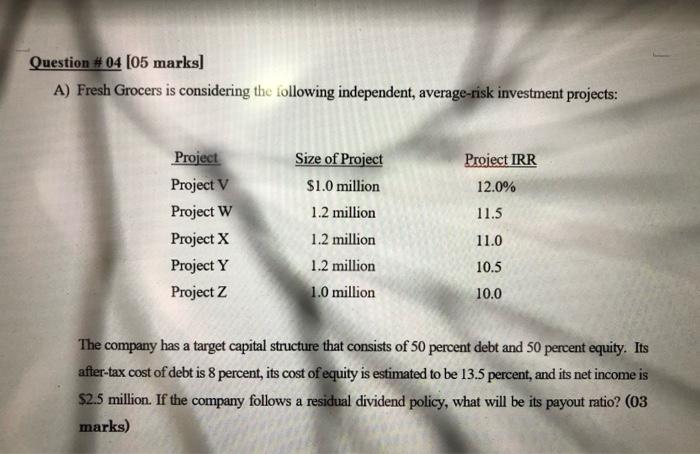

Question: Question # 04 (05 marks) A) Fresh Grocers is considering the following independent, average-risk investment projects: Size of Project Project IRR $1.0 million 12.0% Project

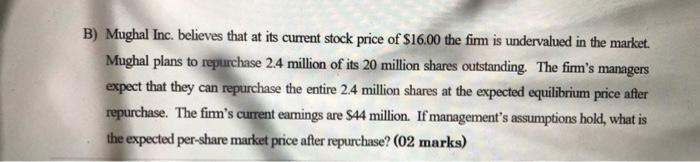

Question # 04 (05 marks) A) Fresh Grocers is considering the following independent, average-risk investment projects: Size of Project Project IRR $1.0 million 12.0% Project Project V Project W Project X Project Y 1.2 million 11.5 1.2 million 11.0 1.2 million 10.5 Project Z 1.0 million 10.0 The company has a target capital structure that consists of 50 percent debt and 50 percent equity. Its after-tax cost of debt is 8 percent, its cost of equity is estimated to be 13.5 percent, and its net income is $2.5 million. If the company follows a residual dividend policy, what will be its payout ratio? (03 marks) B) Mughal Inc. believes that at its current stock price of $16.00 the fimm is undervalued in the market. Mughal plans to repurchase 2.4 million of its 20 million shares outstanding. The fim's managers expect that they can repurchase the entire 2.4 million shares at the expected equilibrium price after repurchase. The fim's current eamings are S44 million. If management's assumptions bold, what is the expected per-share market price after repurchase? (02 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts