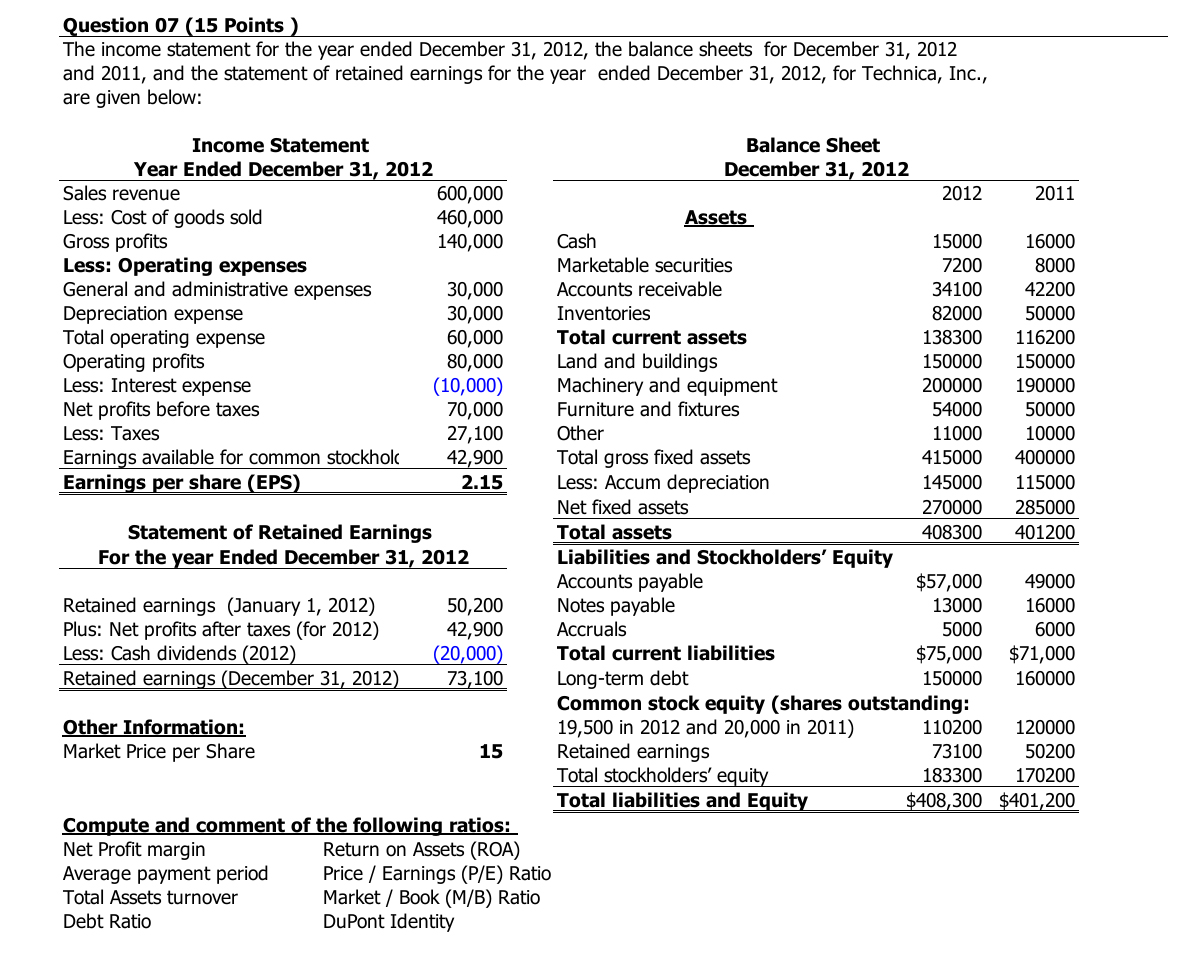

Question: Question 07 (15 Points) The income statement for the year ended December 31, 2012, the balance sheets for December 31, 2012 and 2011, and the

Question 07 (15 Points) The income statement for the year ended December 31, 2012, the balance sheets for December 31, 2012 and 2011, and the statement of retained earnings for the year ended December 31, 2012, for Technica, Inc., are given below: Income Statement Balance Sheet Year Ended December 31, 2012 December 31, 2012 Sales revenue 600,000 2012 2011 Less: Cost of goods sold 460,000 Assets Gross profits 140,000 Cash 15000 16000 Less: Operating expenses Marketable securities 7200 8000 General and administrative expenses 30,000 Accounts receivable 34100 42200 Depreciation expense 30,000 Inventories 82000 50000 Total operating expense 60,000 Total current assets 138300 116200 Operating profits 80,000 Land and buildings 150000 150000 Less: Interest expense (10,000) Machinery and equipment 200000 190000 Net profits before taxes 70,000 Furniture and fixtures 54000 50000 Less: Taxes 27,100 Other 11000 10000 Earnings available for common stockhol 42,900 Total gross fixed assets 415000 400000 Earnings per share (EPS) 2.15 Less: Accum depreciation 145000 115000 Net fixed assets 270000 285000 Statement of Retained Earnings Total assets 408300 401200 For the year Ended December 31, 2012 Liabilities and Stockholders' Equity Accounts payable $57,000 49000 Retained earnings (January 1, 2012) 50,200 Notes payable 13000 16000 Plus: Net profits after taxes (for 2012) 42,900 Accruals 5000 6000 Less: Cash dividends (2012) (20,000) Total current liabilities $75,000 $71,000 Retained earnings (December 31, 2012) 73,100 Long-term debt 150000 160000 Common stock equity (shares outstanding: Other Information: 19,500 in 2012 and 20,000 in 2011) 110200 120000 Market Price per Share 15 Retained earnings 73100 50200 Total stockholders' equity 183300 170200 Total liabilities and Equity $408,300 $401,200 Compute and comment of the following ratios: Net Profit margin Return on Assets (ROA) age payment period Price / Earnings (P/E) Ratio Total Assets turnover Market / Book (M/B) Ratio Debt Ratio DuPont Identity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts