Question: Question 1 0 0.5 points On a standard expected return versus standard deviation graph, risk-averse investors will prefer portfolios that lie to the_. investment opportunity

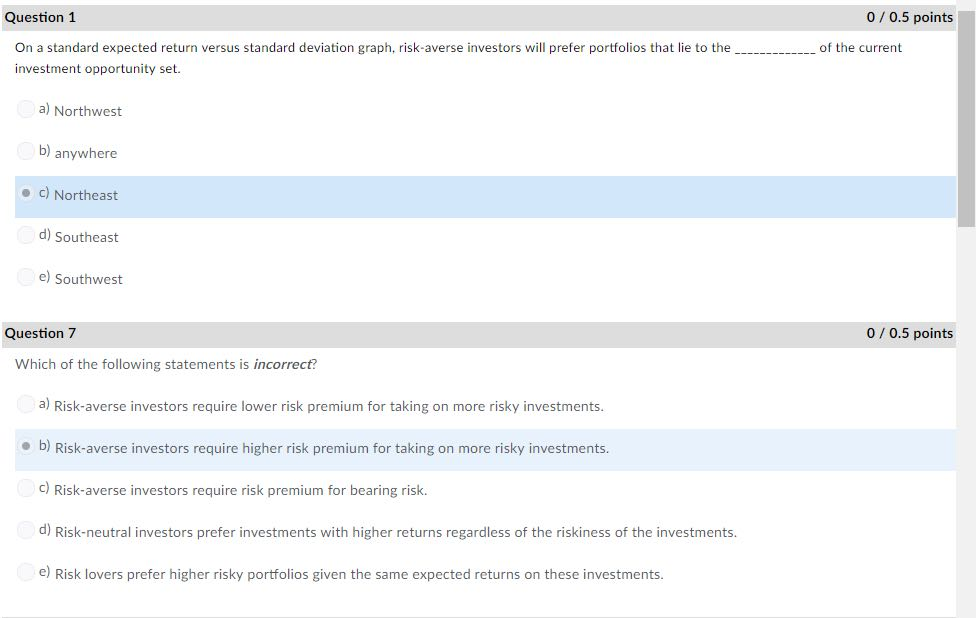

Question 1 0 0.5 points On a standard expected return versus standard deviation graph, risk-averse investors will prefer portfolios that lie to the_. investment opportunity set. of the current a) Northwest b) anywhere o c) Northeast d) Southeast e) Southwest Question 7 0/0.5 points Which of the following statements is incorrect? a) Risk-averse investors require lower risk premium for taking on more risky investments e b) Risk-averse investors require higher risk premium for taking on more risky investments. C) Risk-averse investors require risk premium for bearing risk. d) Risk-neutral investors prefer investments with higher returns regardless of the riskiness of the investments. e) Risk lovers prefer higher risky portfolios given the same expected returns on these investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts