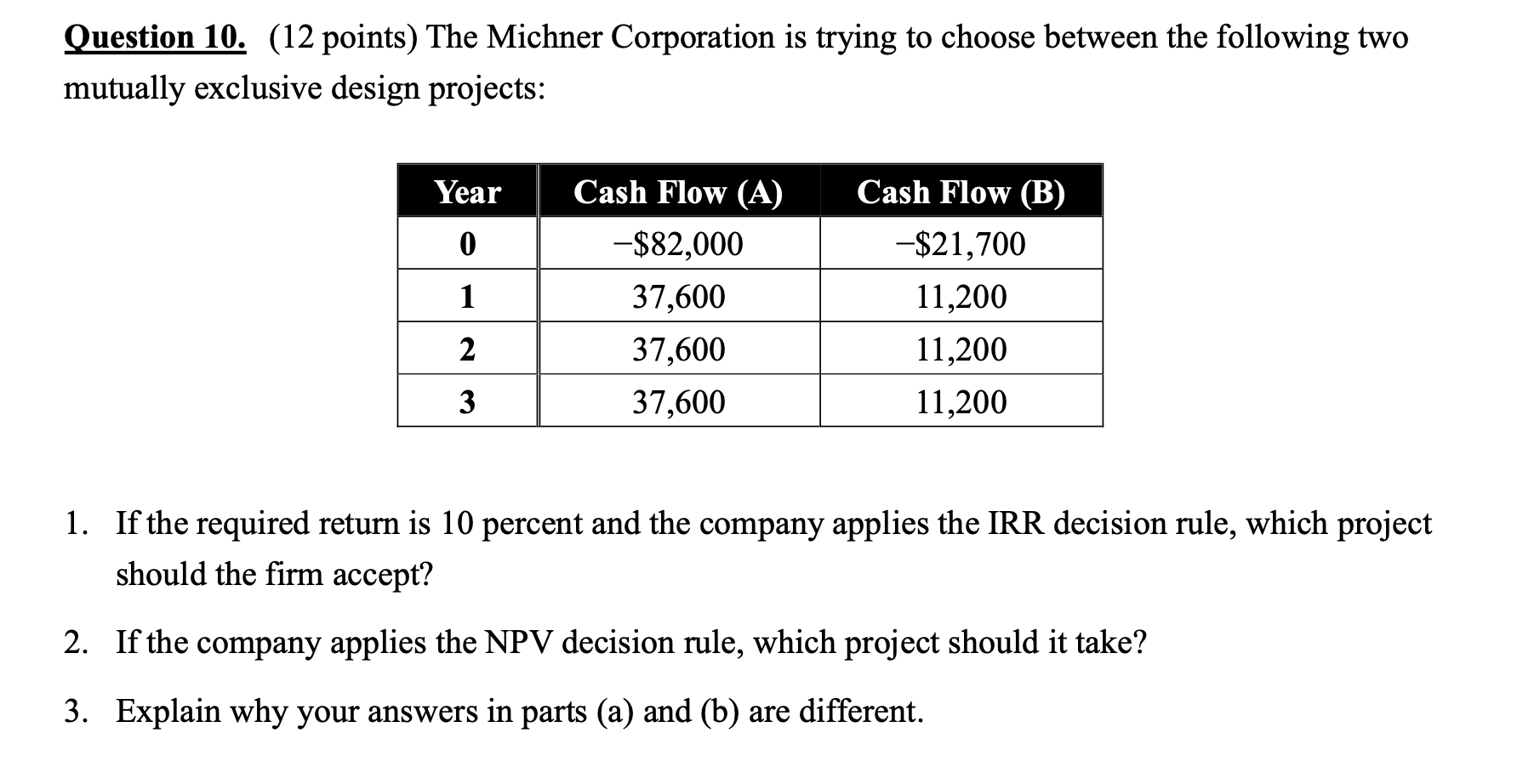

Question: Question 1 0 . ( 1 2 points ) The Michner Corporation is trying to choose between the following two mutually exclusive design projects: If

Question points The Michner Corporation is trying to choose between the following two

mutually exclusive design projects:

If the required return is percent and the company applies the IRR decision rule, which project

should the firm accept?

If the company applies the NPV decision rule, which project should it take?

Explain why your answers in parts a and b are different.The Michner Corporation is trying to choose between the following two mutually exclusive design projectsthe required return is percent, what is the profitabilty index for each project? What is the for each perfect The Michner Corporation is trying to choose between the following two mutually exclusive design projects. If the required return is percent, what is the profitabilty index for eaech project? What is the NPV for each project? Input area: Year Year Year Year Required return Project $ $ $ $ Project II $ $ $ $Use cells A to from the given information to complete this question. You must use the builtin Exc question. Output area: Profitability index Profitability index il NPVI NPV II

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock