Question: Question 1 0 1 pts Which statement does not correctly describe a marital deduction? A marital deduction is available for property transferred to a surviving

Question

pts

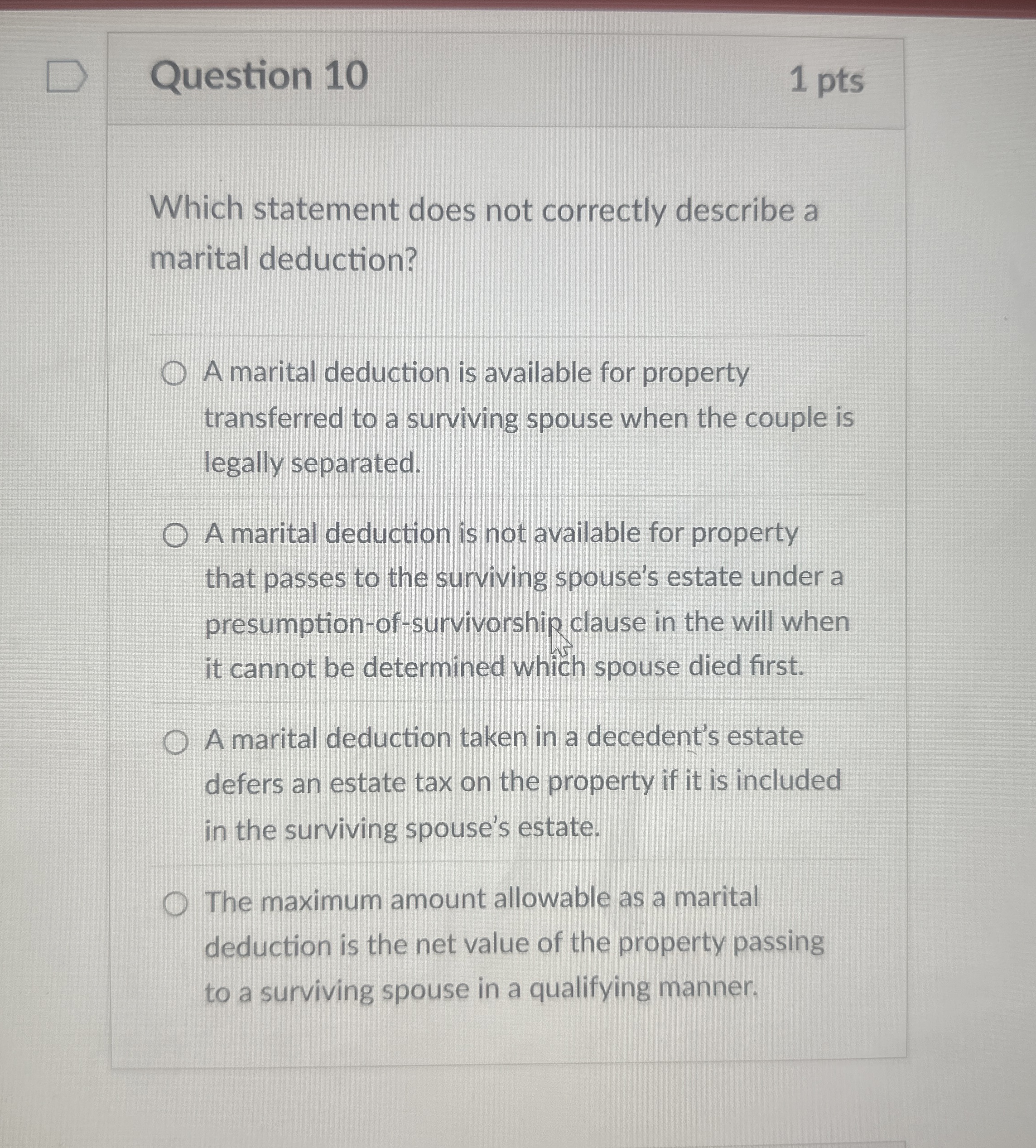

Which statement does not correctly describe a marital deduction?

A marital deduction is available for property transferred to a surviving spouse when the couple is legally separated.

A marital deduction is not available for property that passes to the surviving spouse's estate under a presumptionofsurvivorship clause in the will when it cannot be determined which spouse died first.

A marital deduction taken in a decedent's estate defers an estate tax on the property if it is included in the surviving spouse's estate.

The maximum amount allowable as a marital deduction is the net value of the property passing to a surviving spouse in a qualifying manner.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock