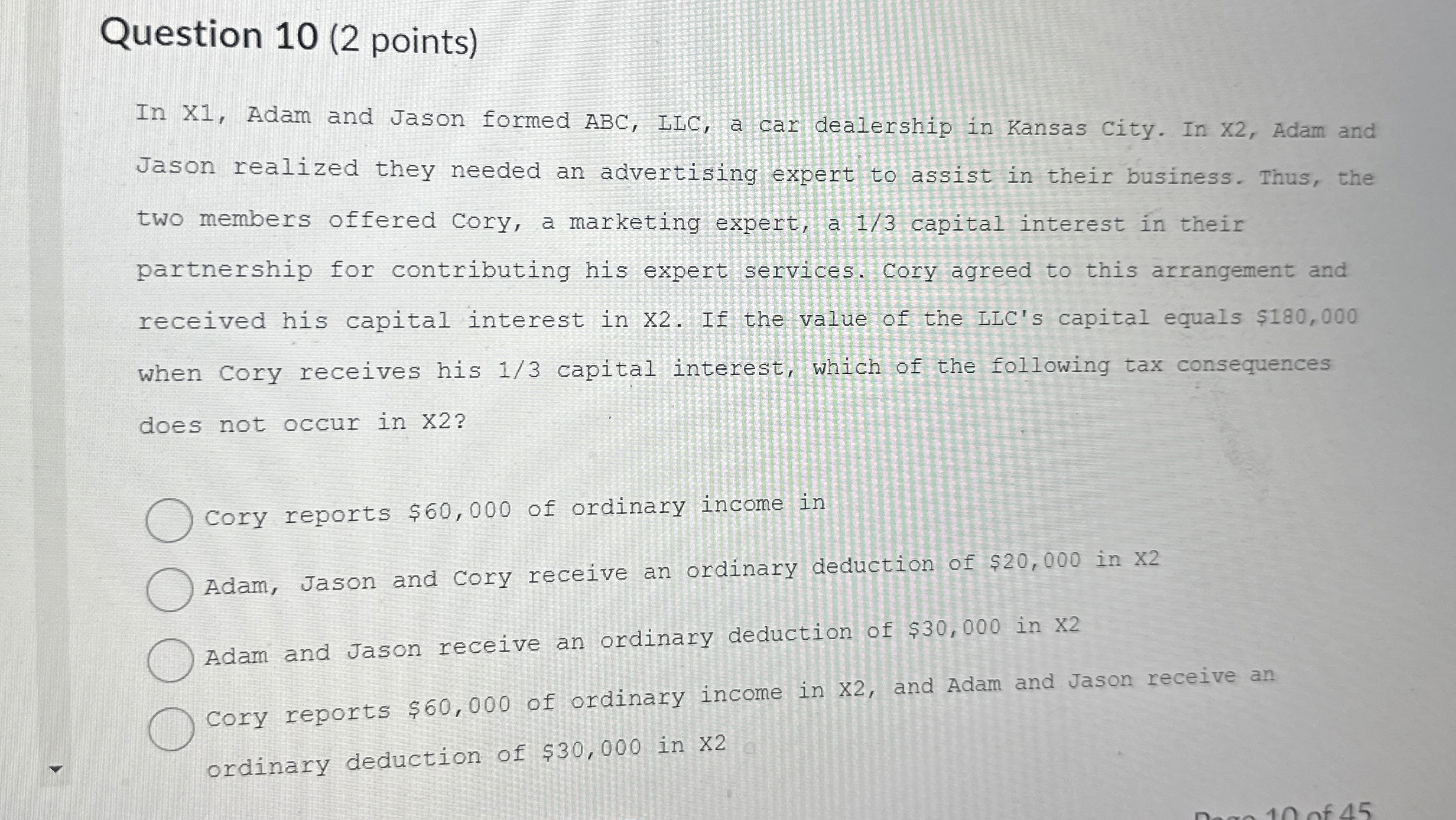

Question: Question 1 0 ( 2 points ) In X 1 , Adam and Jason formed ABC, LIC, a car dealership in Kansas City. In X

Question points

In X Adam and Jason formed ABC, LIC, a car dealership in Kansas City. In X Adam and

Jason realized they needed an advertising expert to assist in their business. Thus, the

two members offered Cory, a marketing expert, a capital interest in their

partnership for contributing his expert services. Cory agreed to this arrangement and

received his capital interest in X If the value of the LLCs capital equals $

when Cory receives his capital interest, which of the following tax consequences

does not occur in x

Cory reports $ of ordinary income in

Adam, Jason and Cory receive an ordinary deduction of $ in x

Adam and Jason receive an ordinary deduction of $ in X

Cory reports $ of ordinary income in X and Adam and Jason receive an

ordinary deduction of $ in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock