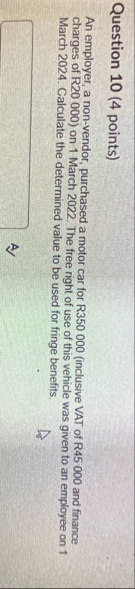

Question: Question 1 0 ( 4 points ) An employer, a non - vendor, purchased a motor car for R 3 5 0 0 0 0

Question points

An employer, a nonvendor, purchased a motor car for Rinclusive VAT of R and finance charges of R on March The free right of use of this vehicle was given to an employee on March Calculate the determined value to be used for fringe benefits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock