Question: Question 1 0 ( Mandatory ) ( 1 point ) The market expected return is 8 % . A risk - averse investor wants to

Question Mandatory point

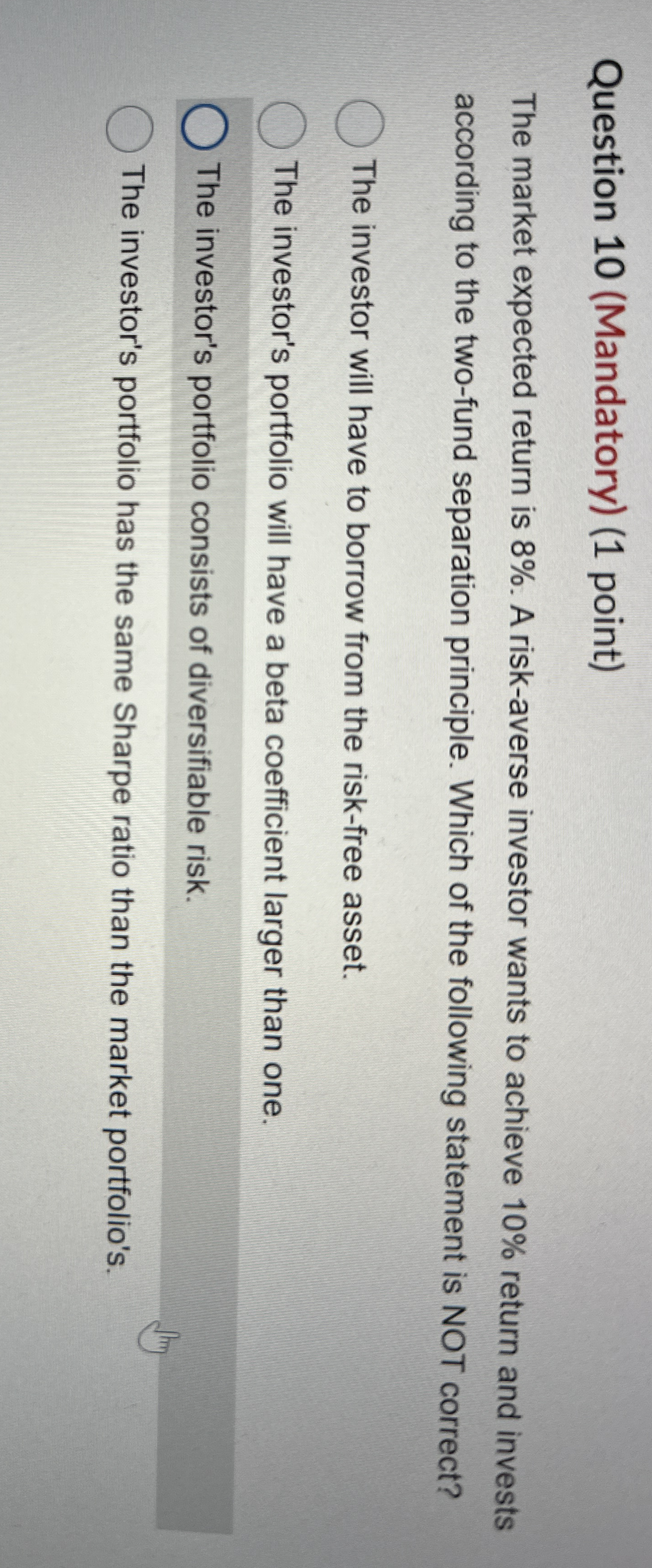

The market expected return is A riskaverse investor wants to achieve return and invests according to the twofund separation principle. Which of the following statement is NOT correct?

The investor will have to borrow from the riskfree asset.

The investor's portfolio will have a beta coefficient larger than one.

The investor's portfolio consists of diversifiable risk.

The investor's portfolio has the same Sharpe ratio than the market portfolio's.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock