Question: QUESTION 1 0 points Save Answer A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual

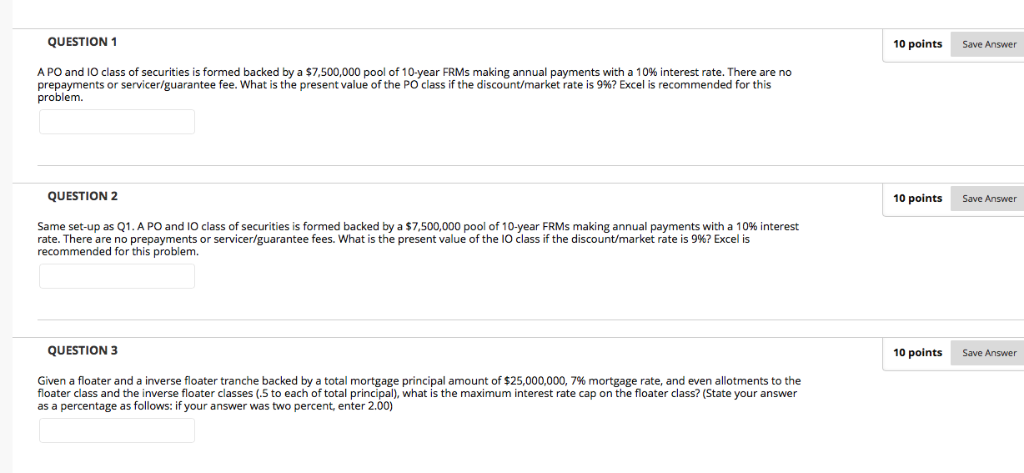

QUESTION 1 0 points Save Answer A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. There are no prepayments or servicer/guarantee fee what is the present value of the PO class if the discount/market rate is g%? Excel is recommended for this problem QUESTION 2 10 points Save Answer Same set-up as Q1. A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. There are no prepayments or servicer/guarantee fees, what is the present value of the IO class if the discount/market rate is 9%? Excel is recommended for this problem. QUESTION 3 10 points Save Answer Given a floater and a inverse floater tranche backed by a total mortgage principal amount of $25,000,000, 7% mortgage rate, and even allotments to the loater class and the inverse floater classes (5 to each of total principal), what is the maximum interest rate cap on the floater class? (State your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts