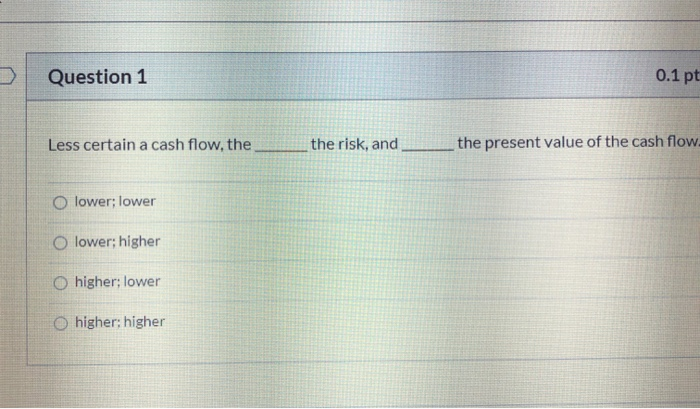

Question: Question 1 0.1 pt Less certain a cash flow, the the risk, and the present value of the cash flow. O lower; lower O lower;

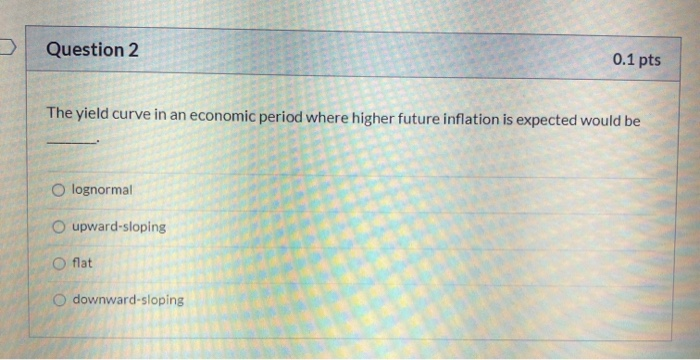

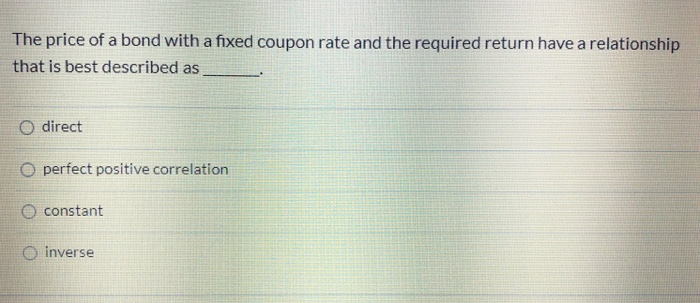

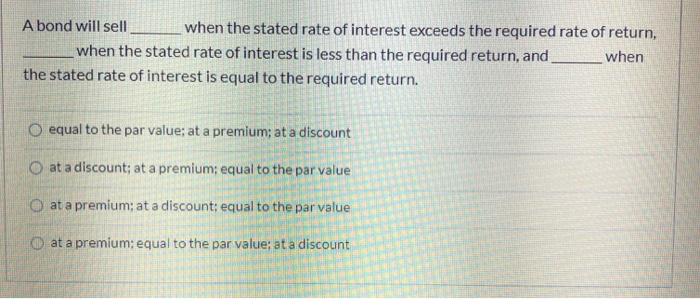

Question 1 0.1 pt Less certain a cash flow, the the risk, and the present value of the cash flow. O lower; lower O lower; higher O higher; lower O higher: higher Question 2 0.1 pts The yield curve in an economic period where higher future inflation is expected would be lognormal O upward-sloping O flat downward sloping The price of a bond with a fixed coupon rate and the required return have a relationship that is best described as direct perfect positive correlation constant O inverse A bond will sell when the stated rate of interest exceeds the required rate of return, when the stated rate of interest is less than the required return, and when the stated rate of interest is equal to the required return. O equal to the par value; at a premium; at a discount O at a discount; at a premium: equal to the par value O at a premium; at a discount: equal to the par value at a premium; equal to the par value: at a discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts