Question: Question 1 0/1 pts Wilma is considering opening a widget factory. The unlevered cost of equity for making widgets is 0.11. This factory would cost

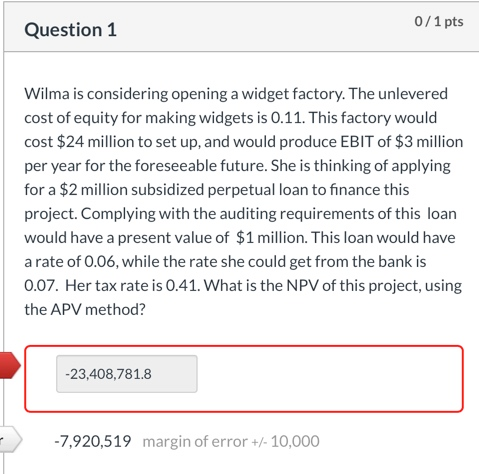

Question 1 0/1 pts Wilma is considering opening a widget factory. The unlevered cost of equity for making widgets is 0.11. This factory would cost $24 million to set up, and would produce EBIT of $3 million per year for the foreseeable future. She is thinking of applying for a $2 million subsidized perpetual loan to finance this project. Complying with the auditing requirements of this loan would have a present value of $1 million. This loan would have a rate of 0.06, while the rate she could get from the bank is 0.07. Her tax rate is 0.41. What is the NPV of this project, using the APV method? -23,408,781.8 -7,920,519 margin of error +/- 10,000 Question 1 0/1 pts Wilma is considering opening a widget factory. The unlevered cost of equity for making widgets is 0.11. This factory would cost $24 million to set up, and would produce EBIT of $3 million per year for the foreseeable future. She is thinking of applying for a $2 million subsidized perpetual loan to finance this project. Complying with the auditing requirements of this loan would have a present value of $1 million. This loan would have a rate of 0.06, while the rate she could get from the bank is 0.07. Her tax rate is 0.41. What is the NPV of this project, using the APV method? -23,408,781.8 -7,920,519 margin of error +/- 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts