Question: Question 1 0/10 Video Submit Excel Online Structured Activity: WACC and optimal capital budget Adamson Corporation is considering four average-risk projects with the following costs

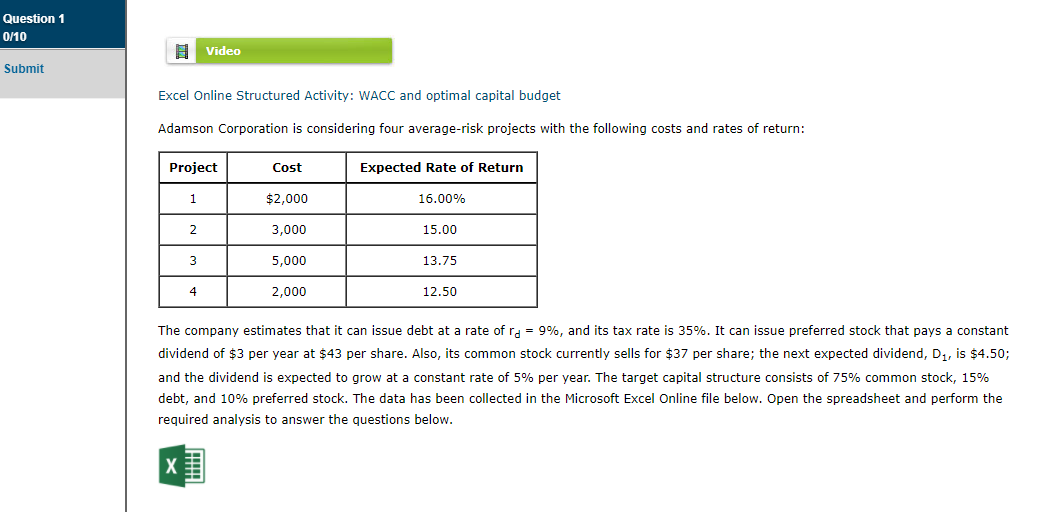

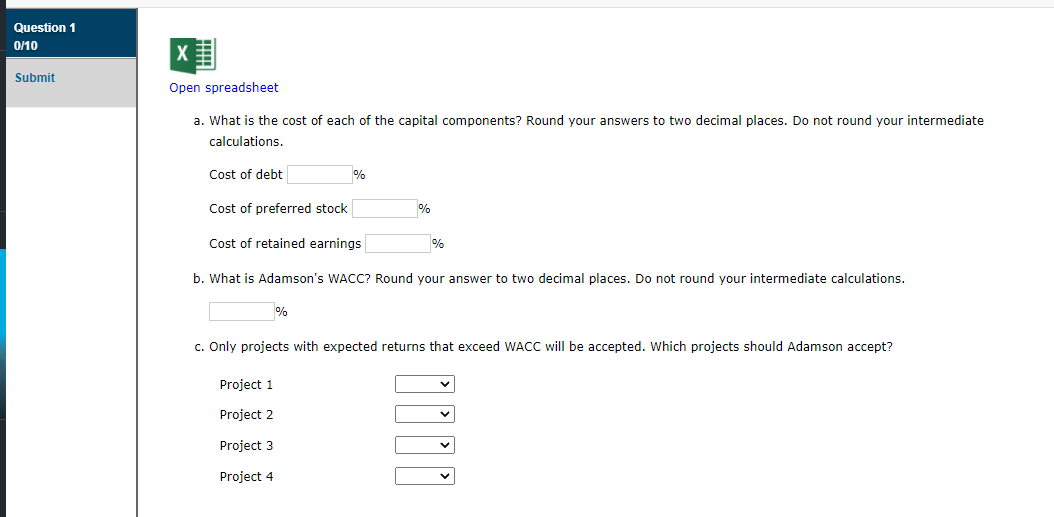

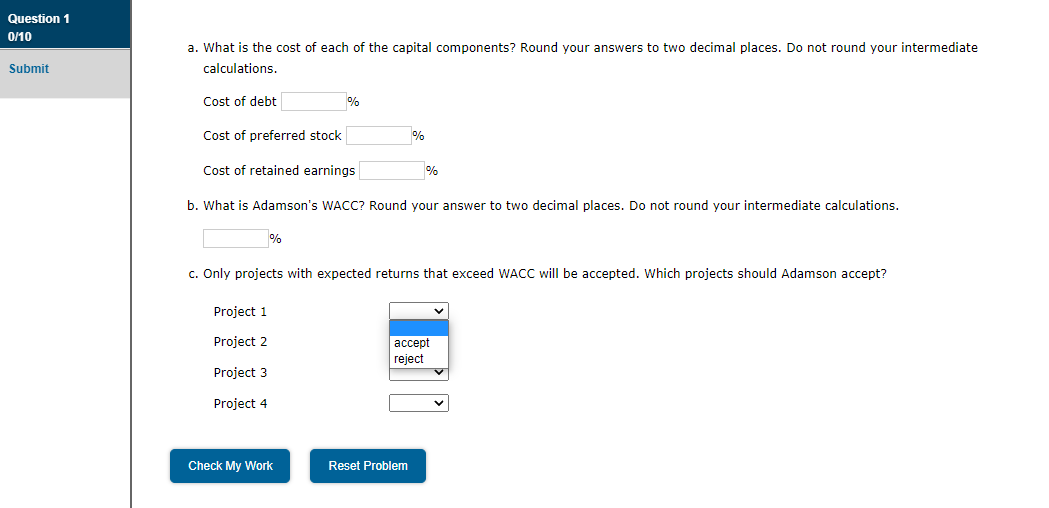

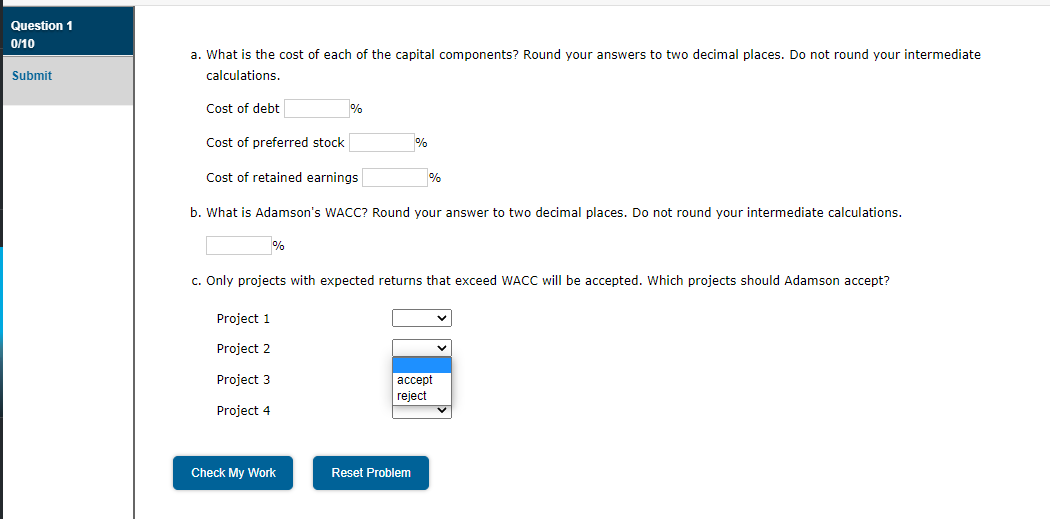

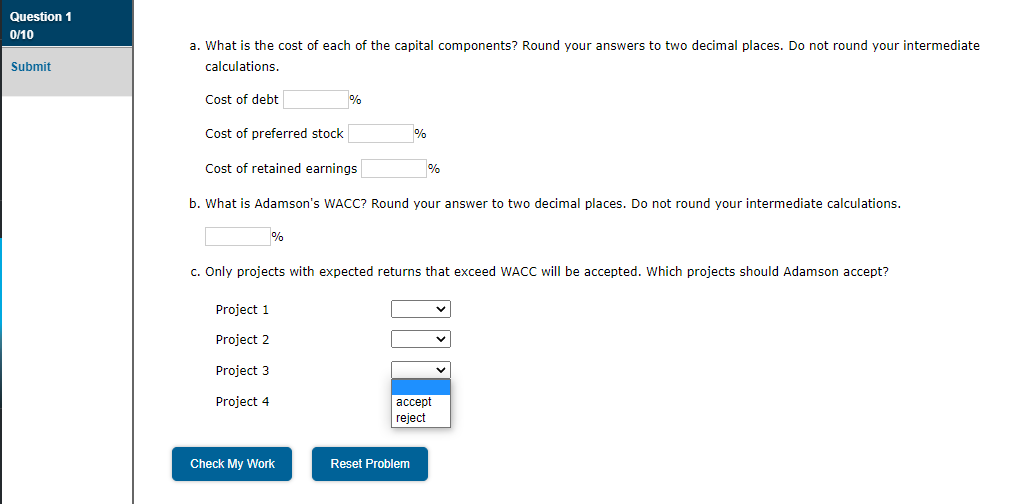

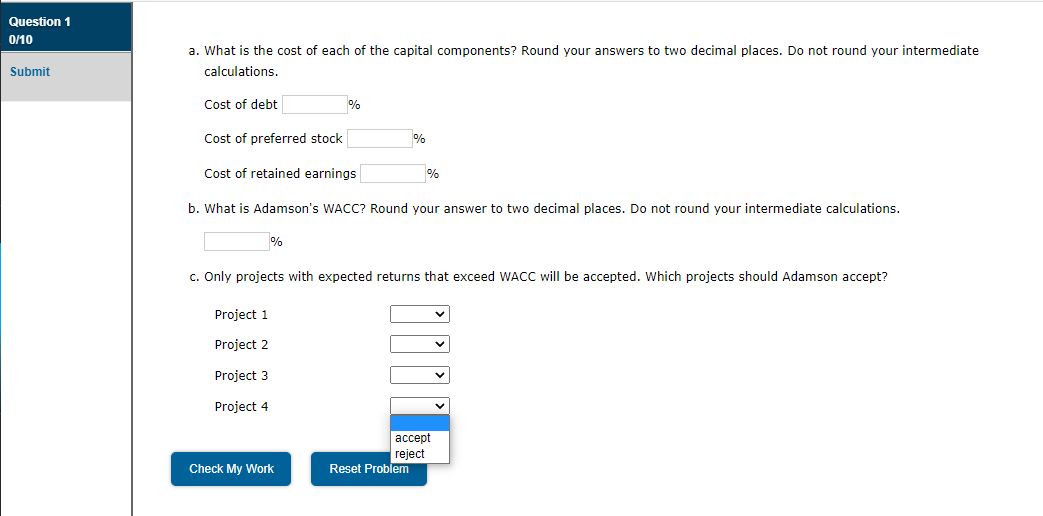

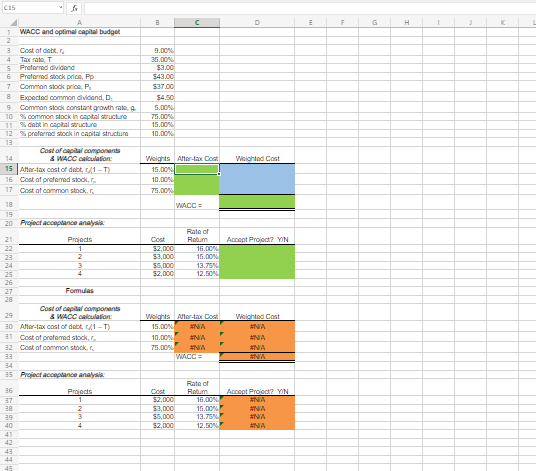

Question 1 0/10 Video Submit Excel Online Structured Activity: WACC and optimal capital budget Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3,000 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of ra = 9%, and its tax rate is 35%. It can issue preferred stock that pays a constant dividend of $3 per year at $43 per share. Also, its common stock currently sells for $37 per share; the next expected dividend, Dj, is $4.50; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Question 1 0/10 Submit Open spreadsheet a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Cost of debt % Cost of preferred stock % Cost of retained earnings % b. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % c. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Illa Project 3 Project 4 Question 1 0/10 a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Submit Cost of debt % Cost of preferred stock % Cost of retained earnings % b. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % C. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 accept reject Project 3 Project 4 Check My Work Reset Problem Question 1 0/10 a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Submit Cost of debt % Cost of preferred stock % Cost of retained earnings % b. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % C. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 accept reject Project 4 Check My Work Reset Problem Question 1 0/10 a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Submit Cost of debt % Cost of preferred stock % Cost of retained earnings b. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % c. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 Project 4 accept reject Check My Work Reset Problem Question 1 0/10 a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Submit Cost of debt % Cost of preferred stock % Cost of retained earnings b. What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % C. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 Project 4 accept reject Reset Problem Check My Work C15 G B E F H 1 3 K WACC and optimal capital budget 9.00 35.00 $3.00 543.00 ST.00 $4.50 5.00 75.00 15.00 10.00% 3 Cost of 4 Tarmato. T 5 Preferred dividend 6 Preferred stock price, PP 7 Common stock price P. 8 Expected common dividend. D. 9 Common stock constant growth rate 10 common stock in capital structure 11 debt in captal structure 12 preferred stock in capital structure 13 Cost of capital components 14 & WACC calculation 15 Artax cost of doi/1-T 16 Cost of preferred stock, 17 Cost of common stockr 18 19 zo Project Acceptance analysis Weighted Cost Weights Allorax Com 15.00 10.00 75.00 WACC= Projects Accept Project? YIN 2 Cost 52.000 53,000 $5,000 2,000 Rate of Rotum 16.00 15.00 13.75 12.50 24 27 Formulas 28 Cost of capital components 29 & WACC calculation 30 Ater-tax cost of debt, /1-T) 31 cost of profered stock 32 Cost of common stock, 23 Weights Alertax Card 15.00 ANA 10.00% ANA 75.00% ANA VACCE Weighted Cost NA ANA ANA ANA 35 Project Acceptance analysis, Practs 26 37 38 Cost $2,000 $3,000 $5,000 $2,000 Rate of Rotum 16.00 15.00 13.75 12.COM Acoept Project? YIN ANA ANA ANA ANA 3 4 40 42 45 44 45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts