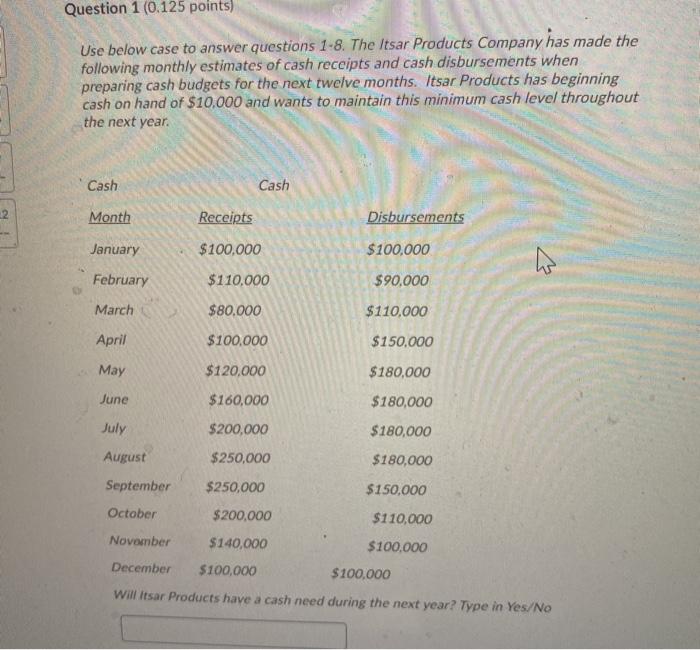

Question: Question 1 (0.125 points) Use below case to answer questions 1-8. The Itsar Products Company has made the following monthly estimates of cash receipts and

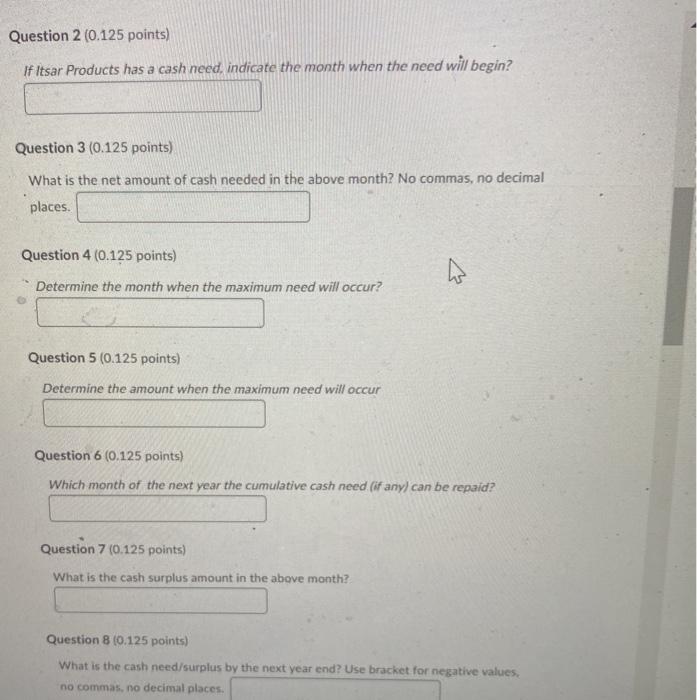

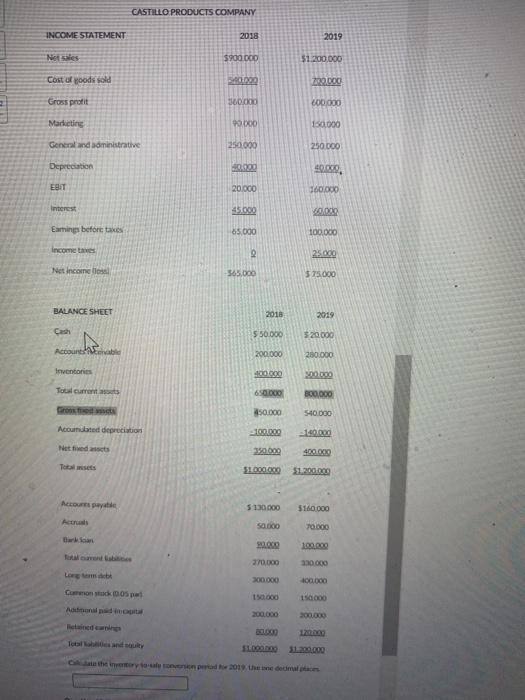

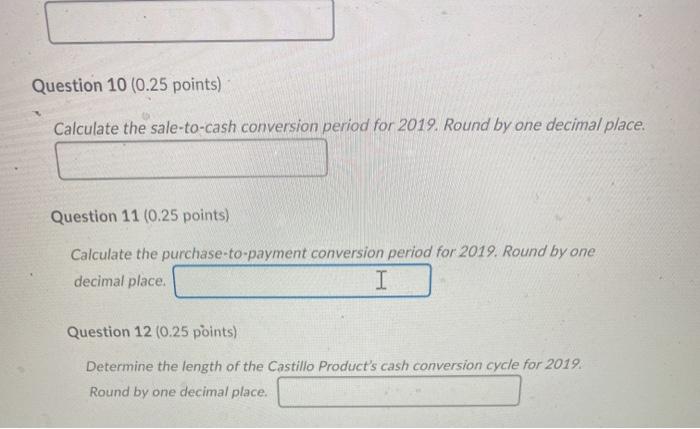

Question 1 (0.125 points) Use below case to answer questions 1-8. The Itsar Products Company has made the following monthly estimates of cash receipts and cash disbursements when preparing cash budgets for the next twelve months. Itsar Products has beginning cash on hand of $10.000 and wants to maintain this minimum cash level throughout the next year. Cash Cash 2 Month Receipts Disbursements January $100,000 $100.000 no February $110.000 $90,000 March $80,000 $110,000 April $100,000 $150,000 May $120,000 $180,000 June $160,000 $180,000 July $180,000 August $180,000 September $200,000 $250,000 $250,000 $200,000 $140,000 $150,000 October $110,000 November $100,000 December $100,000 $100,000 Will Itsar Products have a cash need during the next year? Type in Yes No Question 2 (0.125 points) If Itsar Products has a cash need, indicate the month when the need will begin? Question 3 (0.125 points) What is the net amount of cash needed in the above month? No commas, no decimal places. Question 4 (0.125 points) w Determine the month when the maximum need will occur? Question 5 (0.125 points) Determine the amount when the maximum need will occur Question 6 (0.125 points) Which month of the next year the cumulative cash need (if any) can be repaid? Question 7 (0.125 points) What is the cash surplus amount in the above month? Question 8 (0.125 points) What is the cash need/surplus by the next year end? Use bracket for negative values, no commas, no decimal places. CASTILLO PRODUCTS COMPANY INCOME STATEMENT 2018 2019 Net Sales $900.000 $1.200.000 Cost of yoods sold ZRO DOO Gross profit 300.00 C00.000 Marketing 99.000 10.000 General and administrative 250.000 250.000 Depreciation 2016, EBIT 20.000 160 Rest 45.000 . Earnings before takes 85.000 100.000 Income the 2 250g Net Income 365.000 $75.000 BALANCE SHEET 2016 2019 Cash 550.000 320,000 Account 200.000 250.000 Inventories 400.000 900.000 650.000 300,000 450.000 540.000 Acourated depreciation 100.00 100.000 Nettet 150 000 $1.200.000 5 130.000 110.000 Aca Sa. 000 70.000 Barn SO 70,000 230 000 Lorem Common 1005 200.000 BLOGO SLO DO Question 10 (0.25 points) Calculate the sale-to-cash conversion period for 2019. Round by one decimal place. Question 11 (0.25 points) Calculate the purchase-to-payment conversion period for 2019. Round by one decimal place I Question 12 (0.25 points) Determine the length of the Castillo Product's cash conversion cycle for 2019 Round by one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts