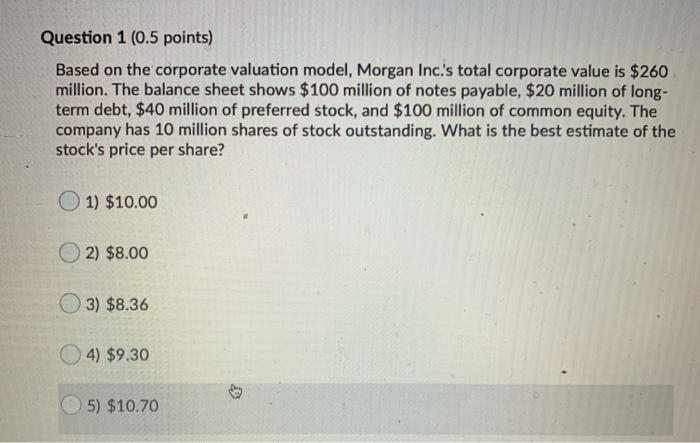

Question: Question 1 (0.5 points) Based on the corporate valuation model, Morgan Inc.'s total corporate value is $260 million. The balance sheet shows $100 million of

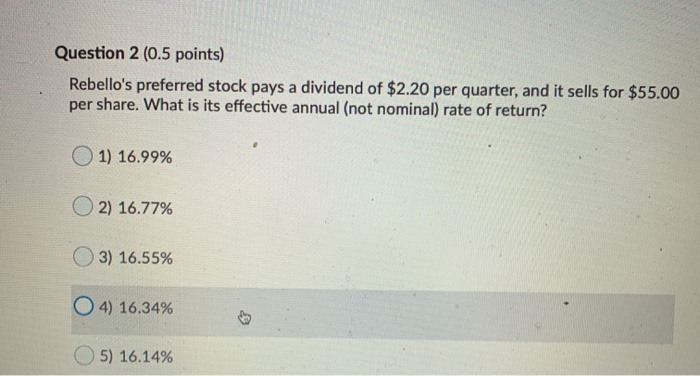

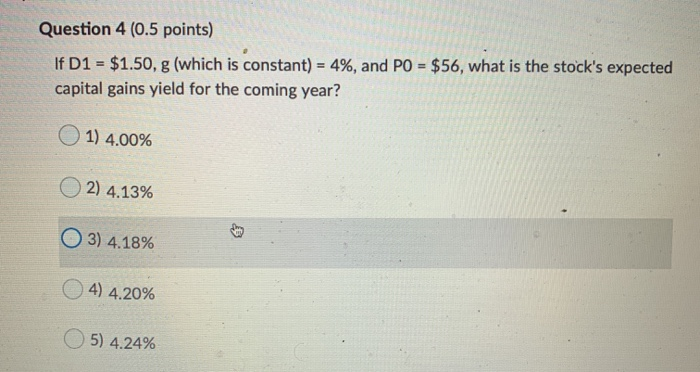

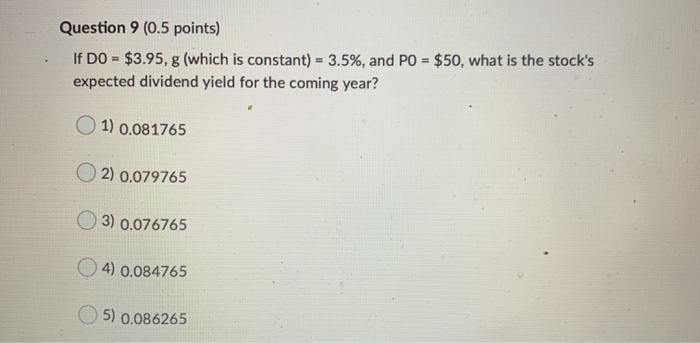

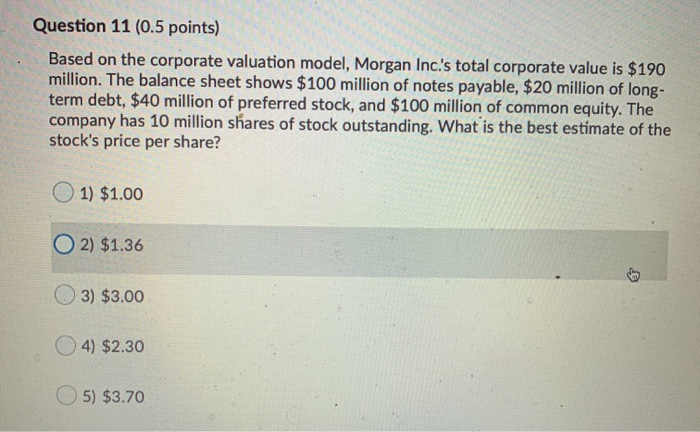

Question 1 (0.5 points) Based on the corporate valuation model, Morgan Inc.'s total corporate value is $260 million. The balance sheet shows $100 million of notes payable, $20 million of long- term debt, $40 million of preferred stock, and $100 million of common equity. The company has 10 million shares of stock outstanding. What is the best estimate of the stock's price per share? 1) $10.00 2) $8.00 O3) $8.36 4) $9.30 5) $10.70 Question 2 (0.5 points) Rebello's preferred stock pays a dividend of $2.20 per quarter, and it sells for $55.00 per share. What is its effective annual (not nominal) rate of return? 1) 16.99% O2) 16.77% 3) 16.55% 04) 16.34% 5) 16.14% Question 4 (0.5 points) If D1 = $1.50, g (which is constant) = 4%, and PO = $56, what is the stock's expected capital gains yield for the coming year? 1) 4.00% 2) 4.13% 3) 4.18% 4) 4.20% 5) 4.24% Question 9 (0.5 points) If DO = $3.95, 8 (which is constant) = 3.5%, and PO = $50, what is the stock's expected dividend yield for the coming year? 1) 0.081765 2) 0.079765 3) 0.076765 4) 0.084765 5) 0.086265 Question 11 (0.5 points) Based on the corporate valuation model, Morgan Inc.'s total corporate value is $190 million. The balance sheet shows $100 million of notes payable, $20 million of long- term debt, $40 million of preferred stock, and $100 million of common equity. The company has 10 million shares of stock outstanding. What is the best estimate of the stock's price per share? 1) $1.00 2) $1.36 Le 3) $3.00 04) $2.30 5) $3.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts