Question: Question 1 0.6 pts Sasparilla County is deciding between two health insurance policies. The county has 19 employees. HealthSavers would require $146,956 today, and would

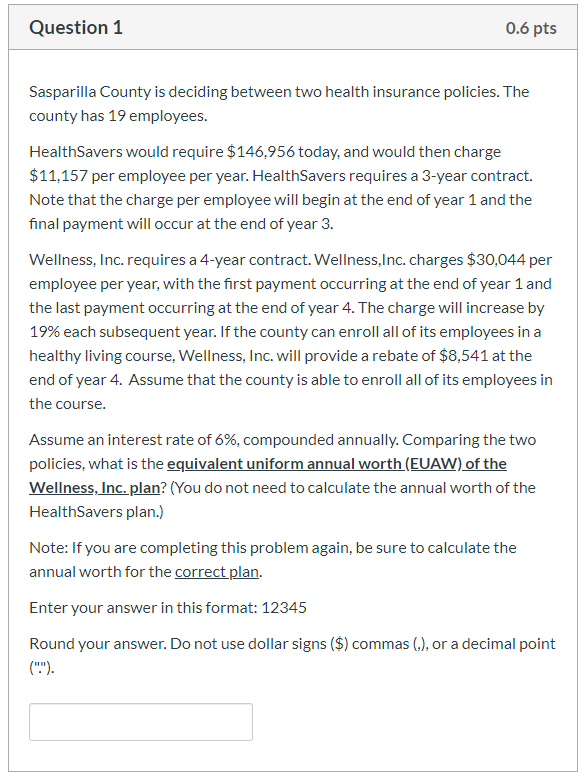

Question 1 0.6 pts Sasparilla County is deciding between two health insurance policies. The county has 19 employees. HealthSavers would require $146,956 today, and would then charge $11,157 per employee per year. HealthSavers requires a 3-year contract. Note that the charge per employee will begin at the end of year 1 and the final payment will occur at the end of year 3. Wellness, Inc. requires a 4-year contract. Wellness, Inc. charges $30,044 per employee per year, with the first payment occurring at the end of year 1 and the last payment occurring at the end of year 4. The charge will increase by 19% each subsequent year. If the county can enroll all of its employees in a healthy living course, Wellness, Inc. will provide a rebate of $8,541 at the end of year 4. Assume that the county is able to enroll all of its employees in the course. Assume an interest rate of 6%, compounded annually. Comparing the two policies, what is the equivalent uniform annual worth (EUAW) of the Wellness, Inc. plan? (You do not need to calculate the annual worth of the HealthSavers plan.) Note: If you are completing this problem again, be sure to calculate the annual worth for the correct plan. Enter your answer in this format: 12345 Round your answer. Do not use dollar signs ($) commas (.), or a decimal point ("")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts