Question: Question 1 ( 1 0 Marks ) The West Texas Intermediate ( WTI ) Light Sweet Crude Oil futures contract, as one of the world's

Question Marks

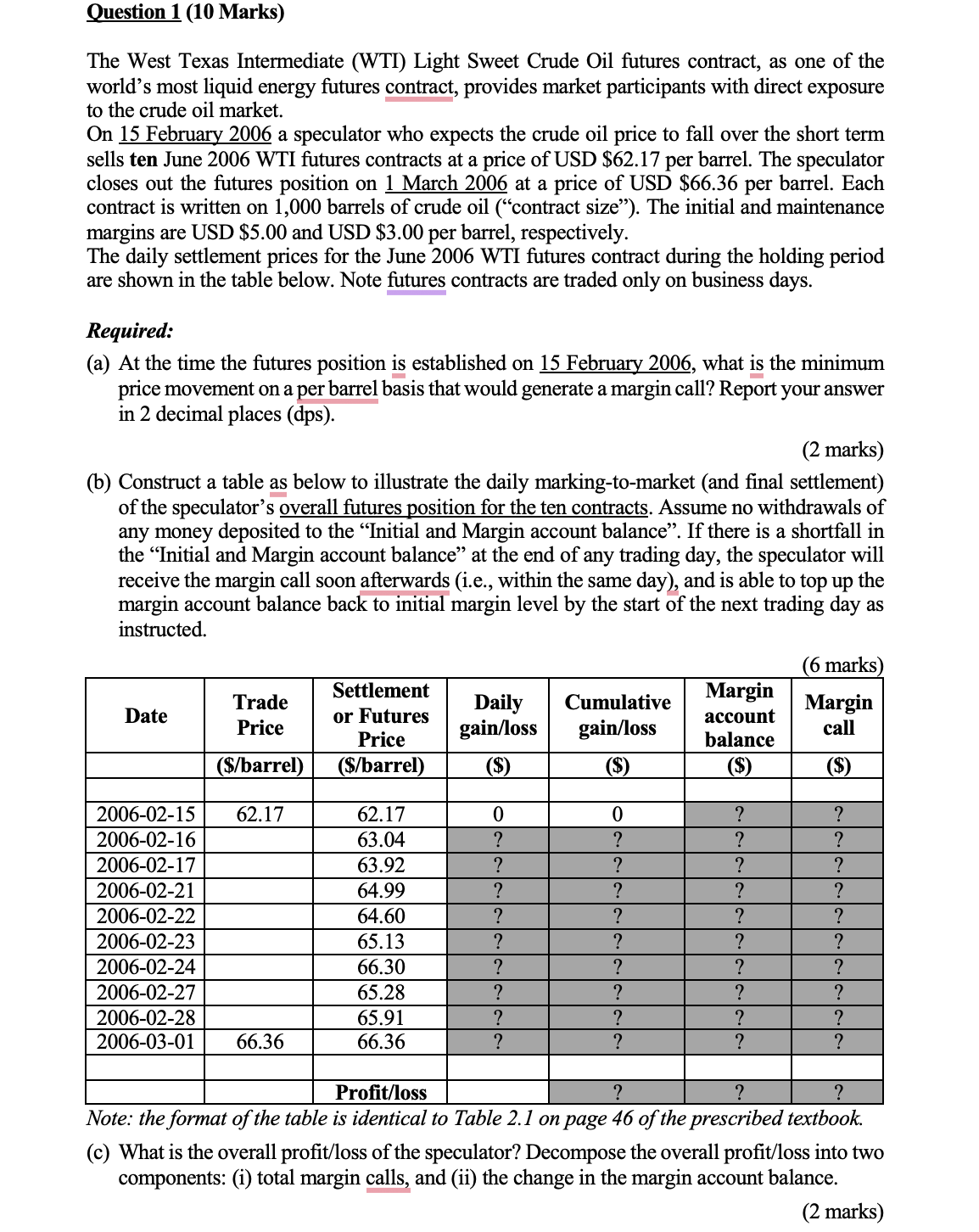

The West Texas Intermediate WTI Light Sweet Crude Oil futures contract, as one of the world's most liquid energy futures contract, provides market participants with direct exposure to the crude oil market.

On February a speculator who expects the crude oil price to fall over the short term sells ten June WTI futures contracts at a price of USD $ per barrel. The speculator closes out the futures position on March at a price of USD $ per barrel. Each contract is written on barrels of crude oil contract size" The initial and maintenance margins are USD $ and USD $ per barrel, respectively.

The daily settlement prices for the June WTI futures contract during the holding period are shown in the table below. Note futures contracts are traded only on business days.

Required:

a At the time the futures position is established on February what is the minimum price movement on a per barrel basis that would generate a margin call? Report your answer in decimal places

marks

b Construct a table as below to illustrate the daily markingtomarket and final settlement of the speculator's overall futures position for the ten contracts. Assume no withdrawals of any money deposited to the "Initial and Margin account balance". If there is a shortfall in the "Initial and Margin account balance" at the end of any trading day, the speculator will receive the margin call soon afterwards ie within the same day and is able to top up the margin account balance back to initial margin level by the start of the next trading day as instructed.

marks

tableDatetableTradePricetableSettlementor FuturesPricetableDailygainlosstableCumulativegainlosstableMarginaccountbalancetableMargincall$barrel$barrel$$$$:bar Profitlossbar

Note: the format of the table is identical to Table on page of the prescribed textbook.

c What is the overall profitloss of the speculator? Decompose the overall profitloss into two components: i total margin calls, and ii the change in the margin account balance.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock