Question: Question 1 ( 1 0 points ) : EOQ Model A tire store expects to sell approximately 1 0 0 all - season tires of

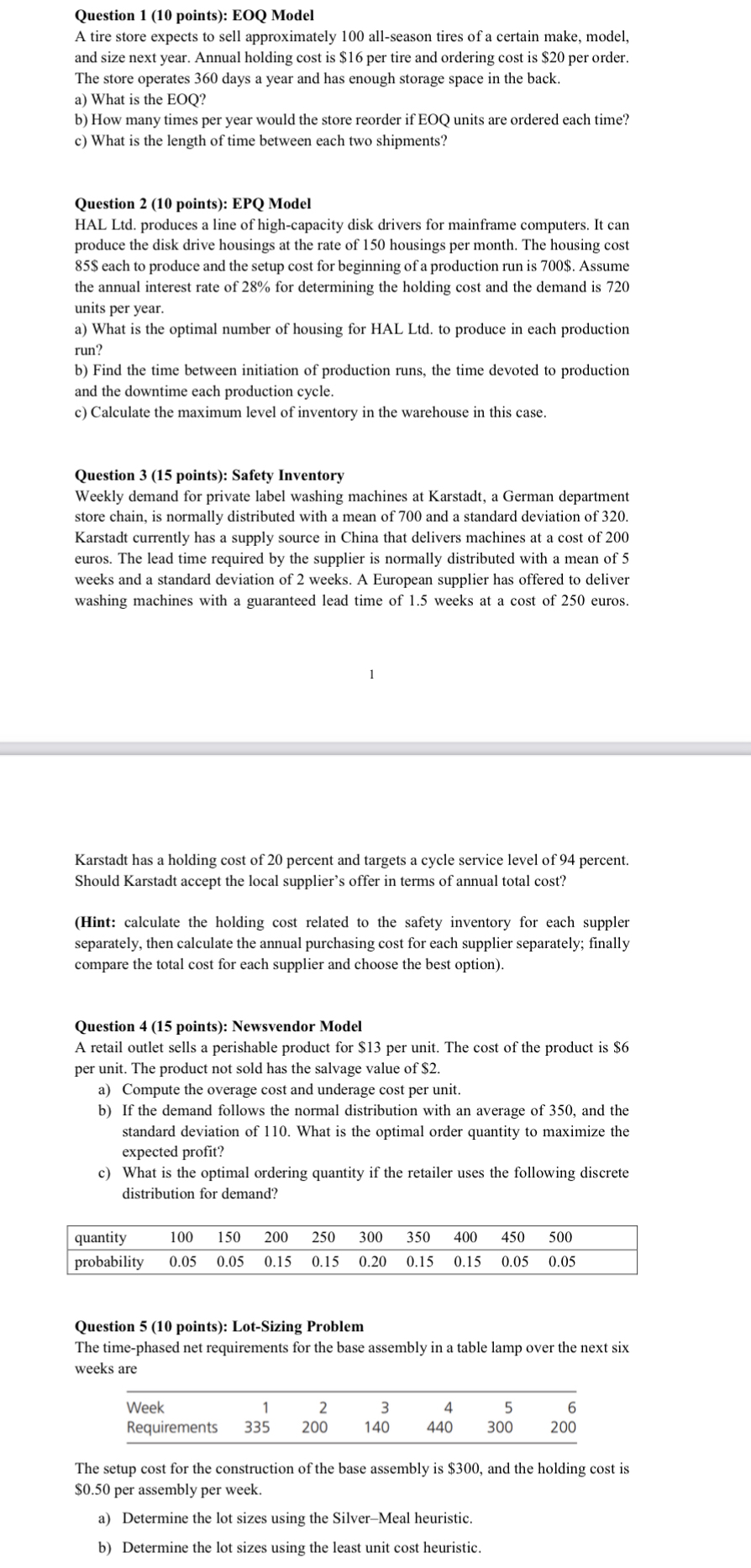

Question points: EOQ Model

A tire store expects to sell approximately allseason tires of a certain make, model, and size next year. Annual holding cost is $ per tire and ordering cost is $ per order. The store operates days a year and has enough storage space in the back.

a What is the EOQ?

b How many times per year would the store reorder if EOQ units are ordered each time?

c What is the length of time between each two shipments?

Question points: EPQ Model

HAL Ltd produces a line of highcapacity disk drivers for mainframe computers. It can produce the disk drive housings at the rate of housings per month. The housing cost $ each to produce and the setup cost for beginning of a production run is $ Assume the annual interest rate of for determining the holding cost and the demand is units per year.

a What is the optimal number of housing for HAL Ltd to produce in each production run?

b Find the time between initiation of production runs, the time devoted to production and the downtime each production cycle.

c Calculate the maximum level of inventory in the warehouse in this case.

Question points: Safety Inventory

Weekly demand for private label washing machines at Karstadt, a German department store chain, is normally distributed with a mean of and a standard deviation of Karstadt currently has a supply source in China that delivers machines at a cost of euros. The lead time required by the supplier is normally distributed with a mean of weeks and a standard deviation of weeks. A European supplier has offered to deliver washing machines with a guaranteed lead time of weeks at a cost of euros.

Karstadt has a holding cost of percent and targets a cycle service level of percent. Should Karstadt accept the local supplier's offer in terms of annual total cost?

Hint: calculate the holding cost related to the safety inventory for each suppler separately, then calculate the annual purchasing cost for each supplier separately; finally compare the total cost for each supplier and choose the best option

Question points: Newsvendor Model

A retail outlet sells a perishable product for $ per unit. The cost of the product is $ per unit. The product not sold has the salvage value of $

a Compute the overage cost and underage cost per unit.

b If the demand follows the normal distribution with an average of and the standard deviation of What is the optimal order quantity to maximize the expected profit?

c What is the optimal ordering quantity if the retailer uses the following discrete distribution for demand?

tablequantityprobability

Question points: LotSizing Problem

The timephased net requirements for the base assembly in a table lamp over the next six weeks are

tableWeekRequirements

The setup cost for the construction of the base assembly is $ and the holding cost is $ per assembly per week.

a Determine the lot sizes using the SilverMeal heuristic.

b Determine the lot sizes using the least unit cost heuristic.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock