Question: Question 1 ( 1 0 points ) In the current year, Jim M . purchased a condominium in Hilton Head Island, South Carolina. Jim M

Question points

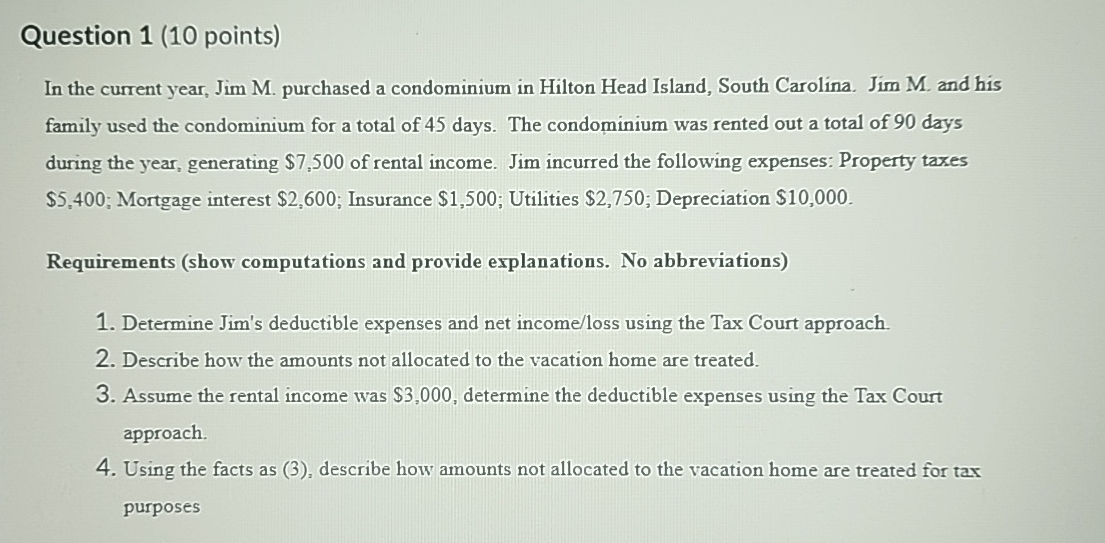

In the current year, Jim M purchased a condominium in Hilton Head Island, South Carolina. Jim M and his family used the condominium for a total of days. The condominium was rented out a total of days during the year, generating $ of rental income. Jim incurred the following expenses: Property taxes $; Mortgage interest $; Insurance $; Utilities $; Depreciation $

Requirements show computations and provide explanations. No abbreviations

Determine Jim's deductible expenses and net incomeloss using the Tax Court approach.

Describe how the amounts not allocated to the vacation home are treated.

Assume the rental income was $ determine the deductible expenses using the Tax Court approach.

Using the facts as describe how amounts not allocated to the vacation home are treated for tax purposes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock