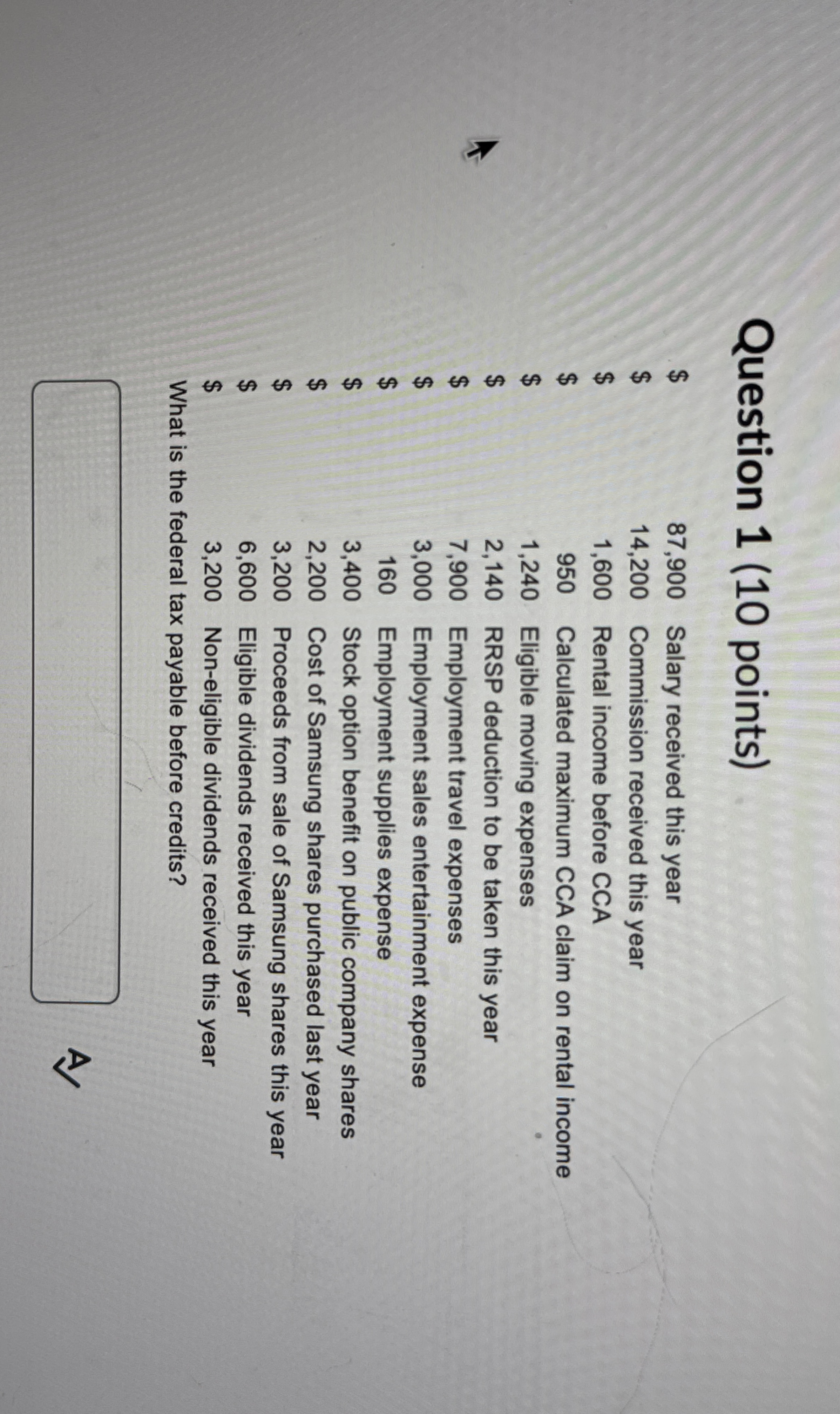

Question: Question 1 ( 1 0 points ) table [ [ $ , 8 7 , 9 0 0 , Salary received this year ]

Question points

table$Salary received this year$Commission received this year$Rental income before CCA$Calculated maximum CCA claim on rental income$Eligible moving expenses$RRSP deduction to be taken this year$Employment travel expenses$Employment sales entertainment expense$Employment supplies expense$Stock option benefit on public company shares$Cost of Samsung shares purchased last year$Proceeds from sale of Samsung shares this year$Eligible dividends received this year$Noneligible dividends received this year

What is the federal tax payable before credits?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock