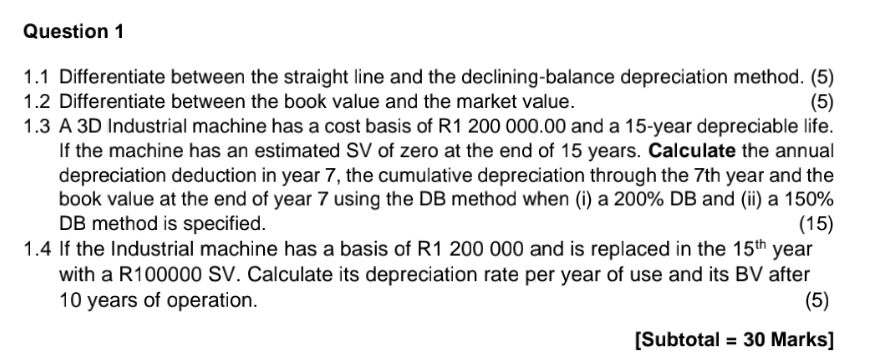

Question: Question 1 1 . 1 Differentiate between the straight line and the declining - balance depreciation method. ( 5 ) 1 . 2 Differentiate between

Question

Differentiate between the straight line and the decliningbalance depreciation method.

Differentiate between the book value and the market value.

A D Industrial machine has a cost basis of R and a year depreciable life. If the machine has an estimated SV of zero at the end of years. Calculate the annual depreciation deduction in year the cumulative depreciation through the th year and the book value at the end of year using the DB method when i a DB and ii a DB method is specified.

If the Industrial machine has a basis of R and is replaced in the year with a R SV Calculate its depreciation rate per year of use and its BV after years of operation.

Subtotal Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock