Question: Question 1 1 ( 1 point ) A recent article in the Providence Journal, has an article today about The Star Building, It recently sold

Question point

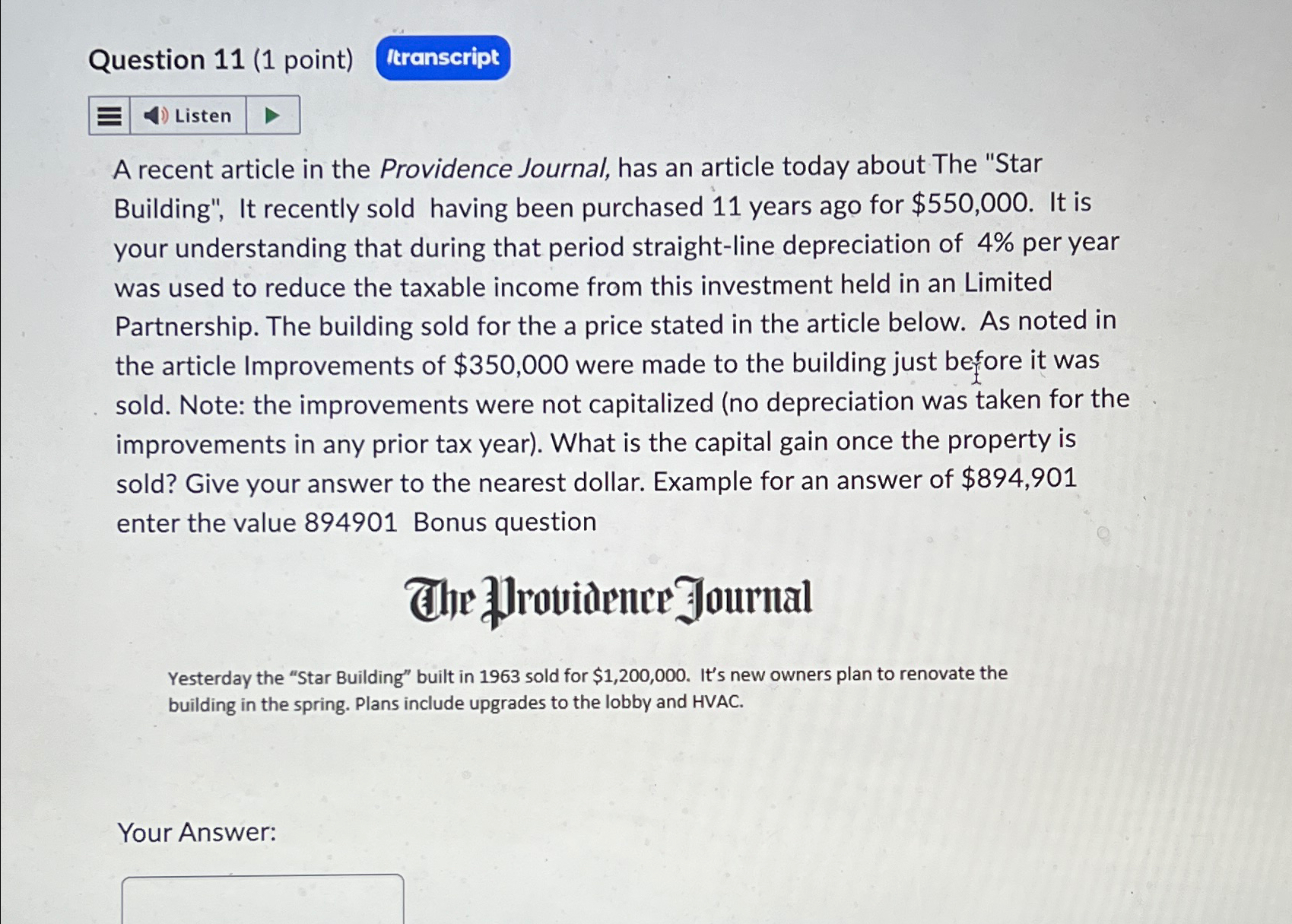

A recent article in the Providence Journal, has an article today about The "Star Building", It recently sold having been purchased years ago for $ It is your understanding that during that period straightline depreciation of per year was used to reduce the taxable income from this investment held in an Limited Partnership. The building sold for the a price stated in the article below. As noted in the article Improvements of $ were made to the building just before it was sold. Note: the improvements were not capitalized no depreciation was taken for the improvements in any prior tax year What is the capital gain once the property is sold? Give your answer to the nearest dollar. Example for an answer of $ enter the value Bonus question

The Ilrouidenter Journal

Yesterday the "Star Building" built in sold for $ It's new owners plan to renovate the building in the spring. Plans include upgrades to the lobby and HVAC.

Your Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock