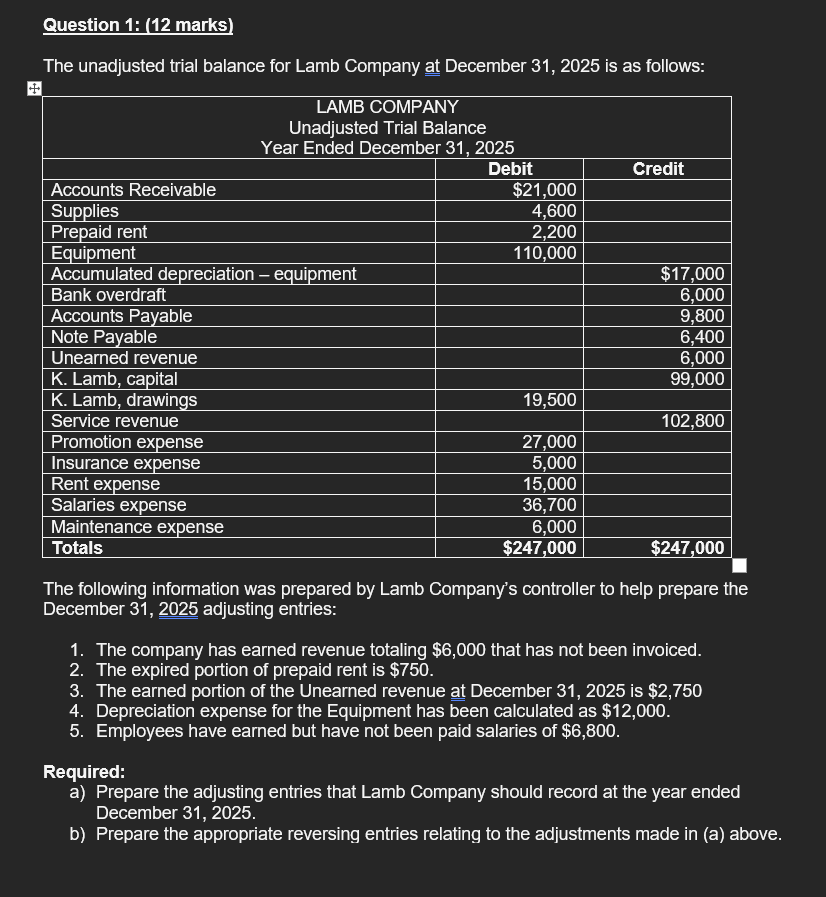

Question: Question 1 : ( 1 2 marks ) The unadjusted trial balance for Lamb Company at December 3 1 , 2 0 2 5 is

Question : marks

The unadjusted trial balance for Lamb Company at December is as follows:

The following information was prepared by Lamb Company's controller to help prepare the

December adjusting entries:

The company has earned revenue totaling $ that has not been invoiced.

The expired portion of prepaid rent is $

The earned portion of the Unearned revenue at December is $

Depreciation expense for the Equipment has been calculated as $

Employees have earned but have not been paid salaries of $

Required:

a Prepare the adjusting entries that Lamb Company should record at the year ended

December

b Prepare the appropriate reversing entries relating to the adjustments made in a above.

Question : marks

Martin Sports Equipment sells a variety of sports items. The following data relates to Martin's

inventory of golf club sets. On March Martin had sets of clubs in inventory at a cost of

$ each. During March, the following transactions occurred:

Mar. Sold seven sets of clubs on account to Flex Golf Club for $ each, cost of goods sold

is $ Terms n

Martin Sports paid cash of $ to ship clubs to Flex Gold Club.

Flex Golf Club returned two sets of clubs. Martin returned the clubs to inventory.

Flex Golf Club paid the account in full.

Purchased eight sets of clubs from Taylor Sports Canada at $ terms n

Freight of $ on the purchase from Taylor was FOB destination and was paid by the

appropriate party.

Sold six sets of clubs at $ each for cash, and gave a discount to the customer

for paying cash. Each set of clubs cost $

Purchased sets of clubs from Lopez Golf for $ each, terms n

Returned one set of clubs to Lopez Golf because they were defective.

Paid the Lopez Golf account.

Required:

a Using the perpetual inventory system, prepare the journal entries to record the

transactions for the month of March. Marks

b Prepare each entry that is different under a periodic inventory system. if you include

entries that are not different in your journal marks will be deducted Marks

Question : marks

The adjusted account balances of Johanna Ltd at December are as follows:

Required:

a Prepare a multistep income statement for the year ended December Marks

b Prepare closing entries for December Marks

Question : Inventory Costing

Part A Marks

Chico Company uses the periodic inventory method and had the following inventory information

available:

A physical count of inventory on December revealed that there were units on hand.

Required:

i Calculate Cost of Good Sold and Ending Inventory using Weighted Average. show all

calculations

ii Calculate Cost of Good Sold and Ending Inventory using FIFO.

show all calculations

Part B Marks

Woodland Printers uses the perpetual inventory system. On September the company's

year end, a physical count was taken of the inventory on hand. The cost of the inventory on hand

was determined to be $ However, the accountant has questions about the following

items:

On the store shelves, the staff counted seven paintings held by Woodland on consignment

from a local artist. The paintings are included on the inventory count at a cost of $

On September a shipment of goods was sent to a customer, FOB destination. The cost

of the goods shipped is $ and freight, which is to be paid by Woodland, will cost $

These items are not included in the inventory count. Delivery is expected to take three days.

On October a freight company delivered goods that cost $ to Woodland's

warehouse. The goods had been shipped by the vendor on September FOB shipping

point. Freight on this shipment will amount to $ and will be paid by the appropriate party.

The goods are not included on the inventory count.

On September a loyal customer visited Woodland's retail shop and asked that certain

items be set aside for him. The goods set aside have a cost of $ The customer intends

to let Woodland know no later than October whether or not he wishes to finalize the sale

and have the goods shipped to his home. The freight will cost $ and will be paid by

Woodland. The salesperson was fairly sure the customer will take the items, and so

Woodland prepared the sales invoice on September The items are not included on the

inventory count.

Residing in Woodland's warehouse is merchandise costing $ that was purchased in

September and found to be defective. Woodland's purchasing manager has arranged with

the vendor to accept return of the goods and has packaged them for return shipment. The

vendor processed a credit to Woodland's account on September and has arranged to

have the goods picked up on October The items are included on the inventory count.

Required:

Calculate the correct inventory balance at September

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock