Question: Question 1 1 ( 2 points ) Interest income is taxable in Canada according to the personal marginal tax rate. To help the municipal government

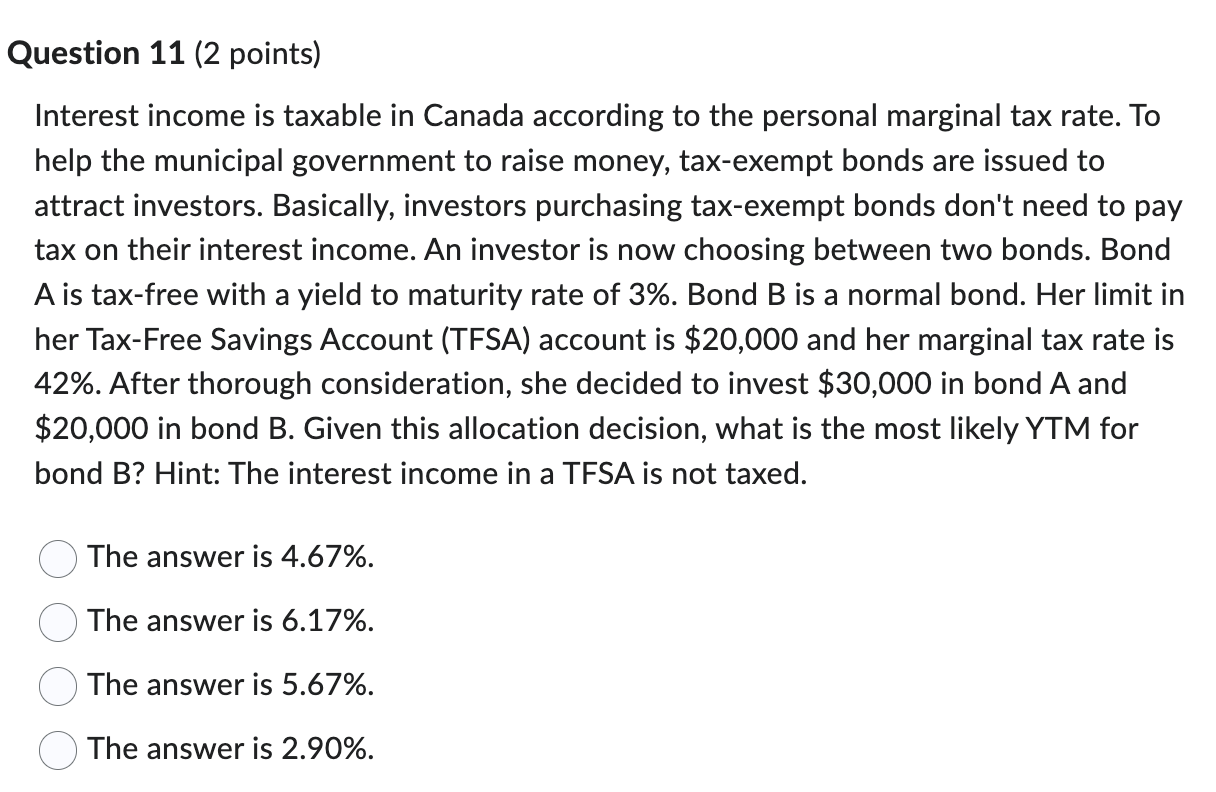

Question points Interest income is taxable in Canada according to the personal marginal tax rate. To help the municipal government to raise money, taxexempt bonds are issued to attract investors. Basically, investors purchasing taxexempt bonds don't need to pay tax on their interest income. An investor is now choosing between two bonds. Bond A is taxfree with a yield to maturity rate of Bond B is a normal bond. Her limit in her TaxFree Savings Account TFSA account is $ and her marginal tax rate is After thorough consideration, she decided to invest $ in bond A and $ in bond B Given this allocation decision, what is the most likely YTM for bond B Hint: The interest income in a TFSA is not taxed. The answer is The answer is The answer is The answer is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock