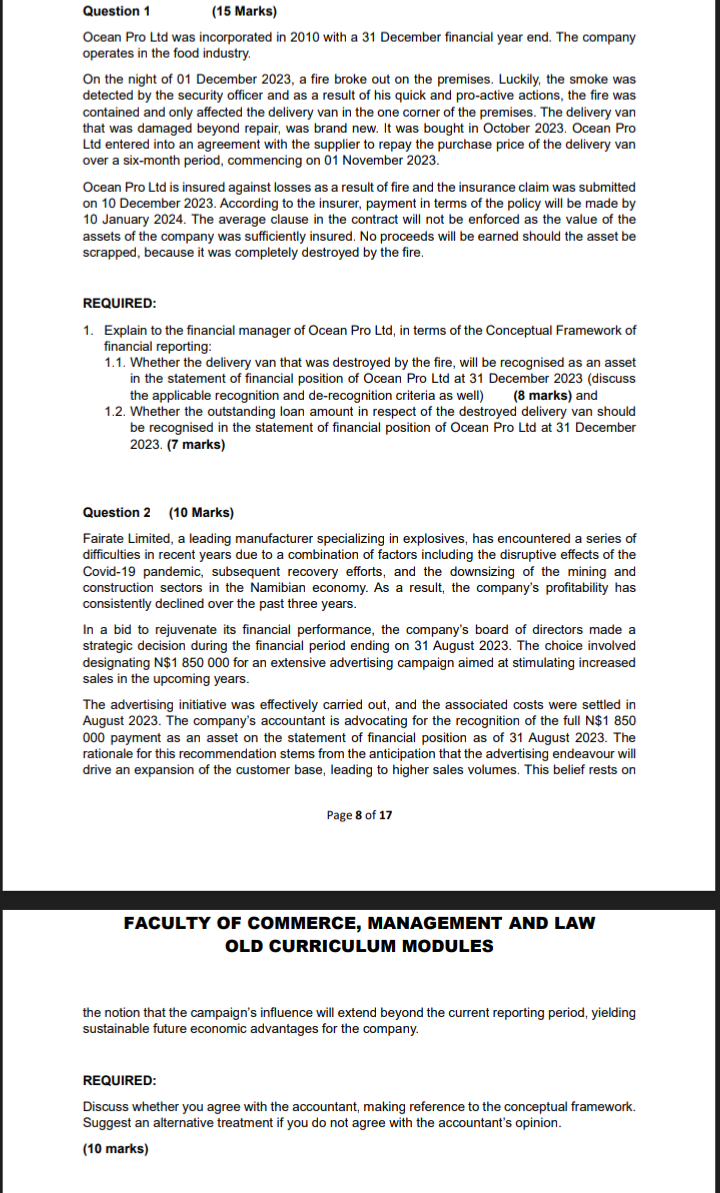

Question: Question 1 ( 1 5 Marks ) Ocean Pro Ltd was incorporated in 2 0 1 0 with a 3 1 December financial year end.

Question

Marks

Ocean Pro Ltd was incorporated in with a December financial year end. The company

operates in the food industry.

On the night of December a fire broke out on the premises. Luckily, the smoke was

detected by the security officer and as a result of his quick and proactive actions, the fire was

contained and only affected the delivery van in the one corner of the premises. The delivery van

that was damaged beyond repair, was brand new. It was bought in October Ocean Pro

Ltd entered into an agreement with the supplier to repay the purchase price of the delivery van

over a sixmonth period, commencing on November

Ocean Pro Ltd is insured against losses as a result of fire and the insurance claim was submitted

on December According to the insurer, payment in terms of the policy will be made by

January The average clause in the contract will not be enforced as the value of the

assets of the company was sufficiently insured. No proceeds will be earned should the asset be

scrapped, because it was completely destroyed by the fire.

REQUIRED:

Explain to the financial manager of Ocean Pro Ltd in terms of the Conceptual Framework of

financial reporting:

Whether the delivery van that was destroyed by the fire, will be recognised as an asset

in the statement of financial position of Ocean Pro Ltd at December discuss

the applicable recognition and derecognition criteria as well marks and

Whether the outstanding loan amount in respect of the destroyed delivery van should

be recognised in the statement of financial position of Ocean Pro Ltd at December

marks

Question Marks

Fairate Limited, a leading manufacturer specializing in explosives, has encountered a series of

difficulties in recent years due to a combination of factors including the disruptive effects of the

Covid pandemic, subsequent recovery efforts, and the downsizing of the mining and

construction sectors in the Namibian economy. As a result, the company's profitability has

consistently declined over the past three years.

In a bid to rejuvenate its financial performance, the company's board of directors made a

strategic decision during the financial period ending on August The choice involved

designating $ for an extensive advertising campaign aimed at stimulating increased

sales in the upcoming years.

The advertising initiative was effectively carried out, and the associated costs were settled in

August The company's accountant is advocating for the recognition of the full N$

payment as an asset on the statement of financial position as of August The

rationale for this recommendation stems from the anticipation that the advertising endeavour will

drive an expansion of the customer base, leading to higher sales volumes. This belief rests on

FACULTY OF COMMERCE, MANAGEMENT AND LAW

OLD CURRICULUM MODULES

the notion that the campaign's influence will extend beyond the current reporting period, yielding

sustainable future economic advantages for the company.

REQUIRED:

Discuss whether you agree with the accountant, making reference to the conceptual framework.

Suggest an alternative treatment if you do not agree with the accountant's opinion.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock